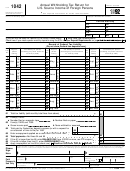

Instructions For Form 1042 - Annual Withholding Tax Return For U.s. Source Income Of Foreign Persons - 2017 Page 5

ADVERTISEMENT

behalf of all your branches other than your

a foreign branch may use chapter 3 status

this results in a negative amount of tax

U.S. branch.

code 12 (Qualified Intermediary) or

liability for the period corresponding to

chapter 4 status code 07 (Registered

line 59, you should instead report any

If you do not have an EIN, you can

Deemed-Compliant FFI-Reporting Model

negative amount for the next earlier

apply for one online at Click

1 FFI), as applicable based on the

period(s) so that you are not reporting any

on "Apply for an EIN Online." You can

chapter 3 or 4 status of the foreign

negative amounts on lines 1-60. See

apply for an EIN by telephone at

branch).

Adjustment to Overwithholding, later.

800-829-4933. You also can file Form

SS-4, Application for Employer

Lines 1-60 must show the

A QI that is a QDD should use the

Identification Number, by fax or mail. File

withholding agent’s record of

!

withholding agent chapter 3 status code

amended Forms 1042-S when you receive

federal tax liability for payments

for a QI (code 12) for purposes of filing its

CAUTION

your EIN.

made during the applicable quarter-

Form 1042, regardless of the types of

monthly period. Withholding agents

To get a QI-EIN, WP-EIN, or WT-EIN,

payments it made for the calendar year.

should report the tax liability for each

submit Form SS-4 with your application for

However, a QI that is a QDD should use

period, rather than the amount of tax

that status. Do not send an application for

the withholding agent chapter 3 status

actually deposited with the IRS.

a QI-EIN, WP-EIN, or WT-EIN to the

code for a QDD (code 35) for purposes of

addresses listed in the Instructions for

reporting on Form 1042-S a payment that

Withholding and depositing of tax

Form SS-4. Send the application along

it made in its capacity as a QDD.

is not required under both

!

with Form SS-4 to:

Special reporting requirements for

chapters 3 and 4 for the same

CAUTION

QDDs. Notice 2016-76 provides

payment. In the case of a payment for

Internal Revenue Service

transitional guidance that applies for 2017

which withholding is required under

LB&I: International: QI Group 1031

for complying with rules pertaining to

290 Broadway, 12th floor

chapters 3 and 4, a withholding agent may

QDDs. The Notice allows a QDD to

credit the withholding applied under

New York, NY 10007-1867 USA

deposit amounts withheld for dividend

chapter 4 against its liability for any tax

equivalents on a quarterly basis, and

due under sections 1441, 1442, or 1443.

Address. Include the suite, room, or

allows a QDD applicant awaiting a QI-EIN

For a payment subject to withholding

other unit number after the street address.

to wait until it receives its QI-EIN to

under section 1445 or 1446, withholding

If your post office does not deliver mail to

deposit amounts withheld on dividend

under chapter 4 does not apply.

the street address and you have a P.O.

equivalents. A QDD relying on either of

box, show the box number instead of the

these provisions will be considered to

Foreign partners of U.S. partnerships

street address.

have timely satisfied its deposit

and foreign beneficiaries of U.S.

requirements for section 871(m) dividend

trusts. To the extent that a domestic

Chapter 3 and 4 status codes of with-

equivalent payments (as long as the

partnership has not distributed a foreign

holding agent. Enter your chapter 3 and

deposit is made within the time prescribed

partner's distributive share of income

chapter 4 status codes from the list of

in the Notice). The QDD should report the

subject to withholding under section 1441,

“Type of Recipient, Withholding Agent,

tax liability on lines 1-60 of the Form 1042

1442, or 1443, or under chapter 4, it

Payer or Intermediary Codes” on Form

for the period in which it actually deposits

should not include any tax liability on lines

1042-S. You must enter both a chapter 3

the amounts withheld. The withholding

1 through 60 for tax relating to the

and a chapter 4 withholding agent status

agent should write “Notice 2016-76” on

partner's distributive share in the year the

code regardless of the type of payment

the center, top portion of the 2017 Form

partnership earns the income. For

being made. See page 2 of these Form

1042 tax return. The Notice also provides

distributive shares not actually distributed,

1042 instructions for definitions of

rules that allow a QDD applicant awaiting

the partnership must include any tax

intermediary, qualified intermediary (QI),

a QI-EIN to represent itself as a QDD on

liability on lines 1 through 60 of the Form

withholding foreign partnership (WP),

documentation provided to a withholding

1042 for the following year. Include the tax

withholding foreign trust (WT),

agent for a limited time. If the QDD

liability on the line that represents the

nonqualified intermediary (NQI), qualified

applicant does not qualify as a QDD, it

earlier of the following dates.

securities lender (QSL), participating FFI,

must immediately notify the withholding

The date on which the Schedule K-1

and registered deemed-compliant FFI.

agent. When this occurs, the withholding

(Form 1065) is sent or otherwise furnished

See the Form 1042-S instructions for

agent must inform the IRS of any such

to the foreign partner.

definitions of U.S. branch of a participating

notifications on its Form 1042 (by

The due date for furnishing

FFI or registered deemed-compliant FFI

attaching a statement), and must list the

Schedule K-1 (Form 1065) to the partner.

treated as a U.S. person, territory financial

name and EIN of each withdrawn QDD on

institution (FI) treated as a U.S. person,

Include such tax liability for the period

the statement.

and flow-through entity.

that includes the date the tax was required

to be withheld. See Regulations section

Withholding agents are to use

Section 1

1.1441-5(b)(2)(i)(A).

specified withholding agent status

!

codes on Forms 1042-S for

A domestic trust should report on lines

Lines 1 through 60. Except as otherwise

CAUTION

payments made by foreign branches of

1 through 60 in the same manner as a

provided in these instructions, include the

U.S. financial institutions. See the 2017

U.S. partnership to the extent that it is

tax liability for the period in which the

instructions for Form 1042-S. However,

required to distribute, but has not actually

income was paid or distributed regardless

the U.S. financial institution should

distributed, a foreign beneficiary's share of

of whether the liability is under chapter 3

continue to use its own withholding agent

distributable net income subject to

or chapter 4 and regardless of whether the

chapter 3 and chapter 4 status codes

withholding under section 1441, 1442, or

liability was satisfied through withholding

(code 01) for purposes of completing

1443, or under chapter 4, before the date

or was paid by the withholding agent (see

Form 1042 if there are any payments

(without extensions) on which the income

instructions for box 9 of Form 1042-S). Do

made by the U.S. home office reflected on

is required to be reported on Form

not enter any negative amounts on these

the form. Otherwise, use chapters 3 and 4

1042-S. See Regulations section

lines. If you are required to report a

status codes 34 and 50 (U.S. Withholding

1.1441-5(b)(2)(ii).

reduction to liability on line 59 (because

Agent-Foreign branch of FI) unless a more

you made a repayment under the

specific status code applies (for example,

reimbursement or setoff procedure), and

Instructions for Form 1042 (2017)

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10