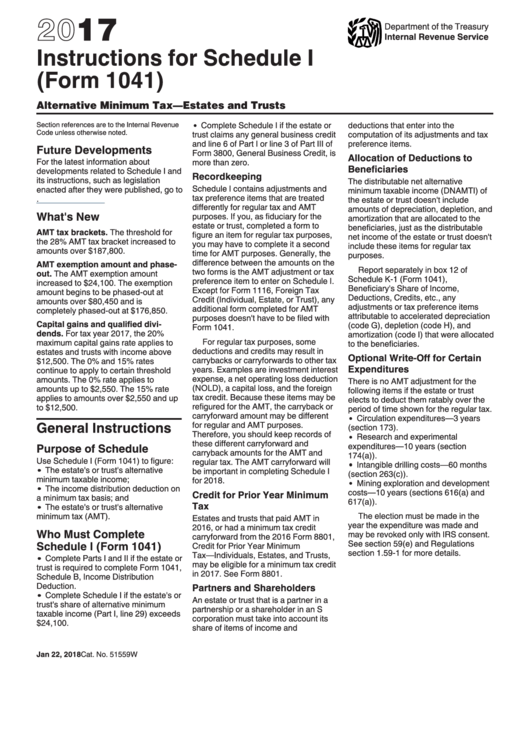

Instructions For Schedule I (Form 1041) - Alternative Minimum Tax-Estates And Trusts - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Schedule I

(Form 1041)

Alternative Minimum Tax—Estates and Trusts

Complete Schedule I if the estate or

deductions that enter into the

Section references are to the Internal Revenue

Code unless otherwise noted.

trust claims any general business credit

computation of its adjustments and tax

and line 6 of Part I or line 3 of Part III of

preference items.

Future Developments

Form 3800, General Business Credit, is

Allocation of Deductions to

For the latest information about

more than zero.

Beneficiaries

developments related to Schedule I and

Recordkeeping

its instructions, such as legislation

The distributable net alternative

Schedule I contains adjustments and

enacted after they were published, go to

minimum taxable income (DNAMTI) of

tax preference items that are treated

IRS.gov/Form1041.

the estate or trust doesn't include

differently for regular tax and AMT

amounts of depreciation, depletion, and

What's New

purposes. If you, as fiduciary for the

amortization that are allocated to the

estate or trust, completed a form to

beneficiaries, just as the distributable

AMT tax brackets. The threshold for

figure an item for regular tax purposes,

net income of the estate or trust doesn't

the 28% AMT tax bracket increased to

you may have to complete it a second

include these items for regular tax

amounts over $187,800.

time for AMT purposes. Generally, the

purposes.

difference between the amounts on the

AMT exemption amount and phase-

Report separately in box 12 of

two forms is the AMT adjustment or tax

out. The AMT exemption amount

Schedule K-1 (Form 1041),

preference item to enter on Schedule I.

increased to $24,100. The exemption

Beneficiary's Share of Income,

Except for Form 1116, Foreign Tax

amount begins to be phased-out at

Deductions, Credits, etc., any

Credit (Individual, Estate, or Trust), any

amounts over $80,450 and is

adjustments or tax preference items

additional form completed for AMT

completely phased-out at $176,850.

attributable to accelerated depreciation

purposes doesn't have to be filed with

Capital gains and qualified divi-

(code G), depletion (code H), and

Form 1041.

dends. For tax year 2017, the 20%

amortization (code I) that were allocated

For regular tax purposes, some

maximum capital gains rate applies to

to the beneficiaries.

deductions and credits may result in

estates and trusts with income above

Optional Write-Off for Certain

carrybacks or carryforwards to other tax

$12,500. The 0% and 15% rates

Expenditures

years. Examples are investment interest

continue to apply to certain threshold

expense, a net operating loss deduction

amounts. The 0% rate applies to

There is no AMT adjustment for the

(NOLD), a capital loss, and the foreign

amounts up to $2,550. The 15% rate

following items if the estate or trust

tax credit. Because these items may be

applies to amounts over $2,550 and up

elects to deduct them ratably over the

refigured for the AMT, the carryback or

to $12,500.

period of time shown for the regular tax.

carryforward amount may be different

Circulation expenditures—3 years

General Instructions

for regular and AMT purposes.

(section 173).

Therefore, you should keep records of

Research and experimental

these different carryforward and

Purpose of Schedule

expenditures—10 years (section

carryback amounts for the AMT and

174(a)).

Use Schedule I (Form 1041) to figure:

regular tax. The AMT carryforward will

Intangible drilling costs—60 months

The estate's or trust's alternative

be important in completing Schedule I

(section 263(c)).

minimum taxable income;

for 2018.

Mining exploration and development

The income distribution deduction on

costs—10 years (sections 616(a) and

Credit for Prior Year Minimum

a minimum tax basis; and

617(a)).

Tax

The estate's or trust's alternative

minimum tax (AMT).

The election must be made in the

Estates and trusts that paid AMT in

year the expenditure was made and

2016, or had a minimum tax credit

Who Must Complete

may be revoked only with IRS consent.

carryforward from the 2016 Form 8801,

Schedule I (Form 1041)

See section 59(e) and Regulations

Credit for Prior Year Minimum

section 1.59-1 for more details.

Tax—Individuals, Estates, and Trusts,

Complete Parts I and II if the estate or

may be eligible for a minimum tax credit

trust is required to complete Form 1041,

in 2017. See Form 8801.

Schedule B, Income Distribution

Deduction.

Partners and Shareholders

Complete Schedule I if the estate's or

An estate or trust that is a partner in a

trust's share of alternative minimum

partnership or a shareholder in an S

taxable income (Part I, line 29) exceeds

corporation must take into account its

$24,100.

share of items of income and

Jan 22, 2018

Cat. No. 51559W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9