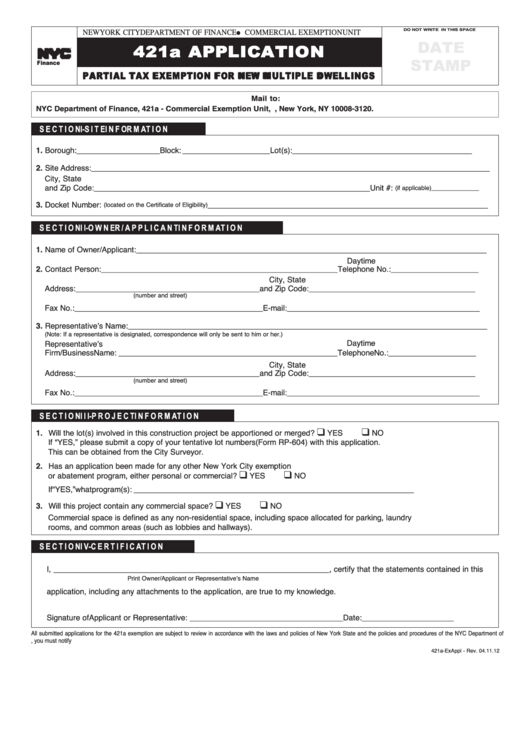

Form 421a - Application Partial Tax Exemption For New Multiple Dwellings

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

COMMERCIAL EXEMPTION UNIT

DO NOT WRITE IN THIS SPACE

DATE

G

4 4 2 2 1 1 a a A A P P P P L L I I C C A A T T I I O O N N

STAMP

TM

Finance

P P A A R R T T I I A A L L T T A A X X E E X X E E M M P P T T I I O O N N F F O O R R N N E E W W M M U U L L T T I I P P L L E E D D W W E E L L L L I I N N G G S S

Mail to:

NYC Department of Finance, 421a - Commercial Exemption Unit, P.O. Box 3120 Church Street Station, New York, NY 10008-3120.

S E C T I O N I - S I T E I N F O R M A T I O N

1. Borough: ___________________

Block: ____________________ Lot(s): _________________________________________

2. Site Address: ___________________________________________________________________________________________

City, State

and Zip Code: _______________________________________________________________ Unit #:

(if applicable) ______________

3. Docket Number:

________________________________________________________________

(located on the Certificate of Eligibility)

S E C T I O N I I - O W N E R / A P P L I C A N T I N F O R M A T I O N

1. Name of Owner/Applicant: ________________________________________________________________________________

Daytime

2. Contact Person: ______________________________________________________

Telephone No.:____________________

City, State

Address: __________________________________________ and Zip Code: ______________________________________

(number and street)

Fax No.:___________________________________________ E-mail: ____________________________________________

3. Representativeʼs Name: __________________________________________________________________________________

(Note: If a representative is designated, correspondence will only be sent to him or her.)

Daytime

Representativeʼs

Firm/Business Name: __________________________________________________

Telephone No.:____________________

City, State

Address: __________________________________________ and Zip Code: ______________________________________

(number and street)

Fax No.:___________________________________________ E-mail: ____________________________________________

S E C T I O N I I I - P R O J E C T I N F O R M A T I O N

1. Will the lot(s) involved in this construction project be apportioned or merged? ...............................................

YES

NO

K

K

If “YES,” please submit a copy of your tentative lot numbers (Form RP-604) with this application.

This can be obtained from the City Surveyor.

2. Has an application been made for any other New York City exemption

or abatement program, either personal or commercial?...................................................................................

YES

NO

K

K

If “YES,” what program(s): ________________________________________________________________

3. Will this project contain any commercial space? ..............................................................................................

YES

NO

K

K

Commercial space is defined as any non-residential space, including space allocated for parking, laundry

rooms, and common areas (such as lobbies and hallways).

S E C T I O N I V - C E R T I F I C A T I O N

I, _______________________________________________________________, certify that the statements contained in this

Print Owner/Applicant or Representativeʼs Name

application, including any attachments to the application, are true to my knowledge.

Signature of Applicant or Representative: ___________________________________

Date:_____________________

All submitted applications for the 421a exemption are subject to review in accordance with the laws and policies of New York State and the policies and procedures of the NYC Department of

Finance. If any information you have provided on this application changes, you must notify Finance immediately. We recommend that you keep a copy of this application for your records.

421a-ExAppl - Rev. 04.11.12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2