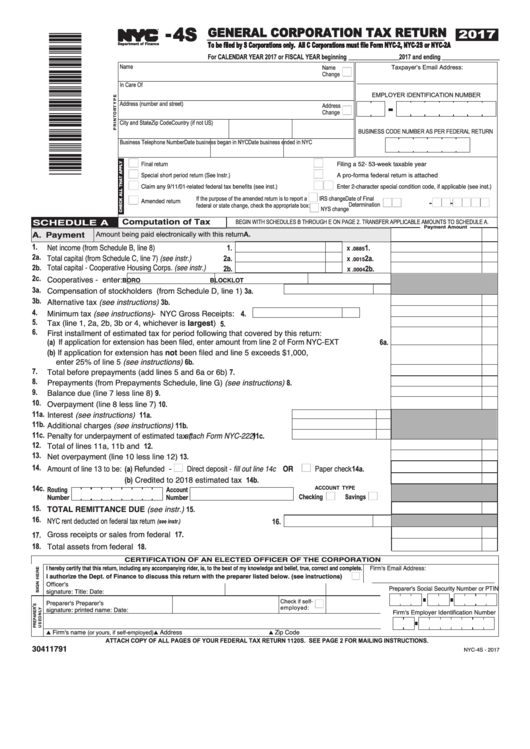

Form Nyc-4s - General Corporation Tax Return - 2017

ADVERTISEMENT

- 4S

GENERAL CORPORATION TAX RETURN

2017

TM

To be filed by S Corporations only. All C Corporations must file Form NYC-2, NYC-2S or NYC-2A

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning _______________ 2017 and ending _________________

Name

Name

n

Taxpayer’s Email Address:

Change

__________________________________________

In Care Of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

Address

n

Change

City and State

Zip Code

Country (if not US)

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Date business began in NYC

Date business ended in NYC

n

n

Filing a 52- 53-week taxable year

Final return

n

n

A pro-forma federal return is attached

Special short period return (See Instr.)

n

nn

Claim any 9/11/01-related federal tax benefits (see inst.)

Enter 2‑character special condition code, if applicable (see inst.)

n

n

nn-nn-nnnn

If the purpose of the amended return is to report a

IRS change

Date of Final

Amended return

n

Determination

federal or state change, check the appropriate box:

NYS change

Computation of Tax

S C H E D U L E A

BEGIN WITH SCHEDULES B THROUGH E ON PAGE 2. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Payment Amount

A. Payment

Amount being paid electronically with this return

A

1.

Net income (from Schedule B, line 8)..................................

1.

1.

X .0885

2a.

Total capital (from Schedule C, line 7) (see instr.)............... 2a.

2a.

X .0015

2b.

Total capital - Cooperative Housing Corps. (see instr.)....... 2b.

2b.

X .0004

2c.

Cooperatives - enter:

BORO

BLOCK

LOT

3a.

Compensation of stockholders (from Schedule D, line 1)........... 3a.

3b.

Alternative tax (see instructions)................................................................................................... 3b.

4.

Minimum tax (see instructions) - NYC Gross Receipts:

....... 4.

5.

Tax (line 1, 2a, 2b, 3b or 4, whichever is largest) .......................................................................... 5.

6.

First installment of estimated tax for period following that covered by this return:

(a) If application for extension has been filed, enter amount from line 2 of Form NYC-EXT................... 6a.

(b) If application for extension has not been filed and line 5 exceeds $1,000,

enter 25% of line 5 (see instructions)........................................................................................ 6b.

7.

Total before prepayments (add lines 5 and 6a or 6b)..................................................................... 7.

8.

Prepayments (from Prepayments Schedule, line G) (see instructions).......................................... 8.

9.

Balance due (line 7 less line 8)....................................................................................................... 9.

10.

Overpayment (line 8 less line 7)................................................................................................... 10.

11a.

Interest (see instructions) ............................................................. 11a.

11b.

Additional charges (see instructions)............................................

11b.

11c.

Penalty for underpayment of estimated tax (attach Form NYC-222)........

11c.

12.

Total of lines 11a, 11b and 11c...................................................................................................... 12.

13.

Net overpayment (line 10 less line 12).......................................................................................... 13.

14.

n

n

Direct deposit - fill out line 14c OR

Amount of line 13 to be: (a) Refunded -

Paper check.......

14a.

(b) Credited to 2018 estimated tax .........................................................

14b.

14c.

Routing

Account

ACCOUNT TYPE

n

n

Checking

Savings

Number

Number

15.

TOTAL REMITTANCE DUE (see instr.) ....................................................................................... 15.

16.

NYC rent deducted on federal tax return

.................................... 16.

(see instr.)

Gross receipts or sales from federal return..................................................................................... 17.

17.

18.

Total assets from federal return....................................................................................................... 18.

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

Firm's Email Address:

n

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)...YES

____________________________________

Officer’s

Preparer's Social Security Number or PTIN

signature:

Title:

Date:

n

Check if self-

Preparer's

Preparer’s

employed:

signature:

printed name:

Date:

Firm's Employer Identification Number

Firm's name

Address

Zip Code

(or yours, if self-employed)

s

s

s

ATTACH COPY OF ALL PAGES OF YOUR FEDERAL TAX RETURN 1120S. SEE PAGE 2 FOR MAILING INSTRUCTIONS.

30411791

NYC-4S - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2