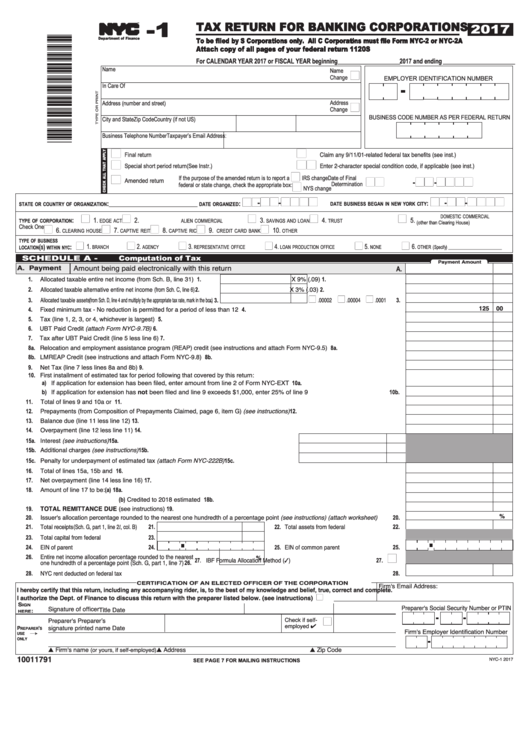

Form Nyc-1 - Tax Return For Banking Corporations - 2017

ADVERTISEMENT

- 1

TAX RETURN FOR BANKING CORPORATIONS

2017

TM

To be filed by S Corporations only. All C Corporations must file Form NYC-2 or NYC-2A

Department of Finance

Attach copy of all pages of your federal return 1120S

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ___________________ 2017 and ending ______________________

Name

Name

n

Change

EMPLOYER IDENTIFICATION NUMBER

In Care Of

n

Address

Address (number and street)

Change

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

City and State

Zip Code

Country (if not US)

Business Telephone Number

Taxpayer’s Email Address:

n

n

Claim any 9/11/01-related federal tax benefits (see inst.)

Final return

n

nn

Enter 2‑character special condition code, if applicable (see inst.)

Special short period return (See Instr.)

n

n

nn-nn-nnnn

If the purpose of the amended return is to report a

IRS change

Date of Final

Amended return

n

Determination

federal or state change, check the appropriate box:

NYS change

nn-nn-nnnn

nn-nn-nnnn

:___________________________

:

:

STATE OR COUNTRY OF ORGANIZATION

DATE ORGANIZED

DATE BUSINESS BEGAN IN NEW YORK CITY

n

n

n

n

n

:

DOMESTIC COMMERCIAL

1.

2.

3.

4.

5.

TYPE OF CORPORATION

EDGE ACT

ALIEN COMMERCIAL

SAVINGS AND LOAN

TRUST

(other than Clearing House)

n

n

n

n

n

Check One

6.

7.

8.

9.

10.

CLEARING HOUSE

CAPTIVE REIT

CAPTIVE RIC

CREDIT CARD BANK

OTHER

TYPE OF BUSINESS

n

n

n

n

n

n

(

)

:

1.

2.

3.

4.

5.

6.

BRANCH

AGENCY

REPRESENTATIVE OFFICE

LOAN PRODUCTION OFFICE

NONE

OTHER (Specify) ______________________

LOCATION

S

WITHIN NYC

S C H E D U L E A - C o m p u t a t i o n o f Ta x

Payment Amount

Amount being paid electronically with this return.............................................................................. A.

A. Payment

1.

Allocated taxable entire net income (from Sch. B, line 31) ......... 1.

X 9% (.09)............................

1.

2.

Allocated taxable alternative entire net income (from Sch. C, line 6).......... 2.

X 3% (.03).............................

2.

n

n

n

3.

Allocated taxable assets (from Sch. D, line 4 and multiply by the appropriate tax rate, mark in the box)... 3.

.00002

.00004

.0001

3.

125

00

4.

Fixed minimum tax - No reduction is permitted for a period of less than 12 months..........................................................................

4.

5.

Tax (line 1, 2, 3, or 4, whichever is largest) .......................................................................................................................................

5.

UBT Paid Credit (attach Form NYC-9.7B) .........................................................................................................................................

6.

6.

7.

Tax after UBT Paid Credit (line 5 less line 6)......................................................................................................................................

7.

8a. Relocation and employment assistance program (REAP) credit (see instructions and attach Form NYC-9.5) ................................

8a.

8b. LMREAP Credit (see instructions and attach Form NYC-9.8) ...........................................................................................................

8b.

9.

Net Tax (line 7 less lines 8a and 8b)...................................................................................................................................................

9.

10. First installment of estimated tax for period following that covered by this return:.............................................................................

a) If application for extension has been filed, enter amount from line 2 of Form NYC-EXT ....................................................... 10a.

b) If application for extension has not been filed and line 9 exceeds $1,000, enter 25% of line 9 ............................................ 10b.

11.

Total of lines 9 and 10a or 10b............................................................................................................................................................

11.

Prepayments (from Composition of Prepayments Claimed, page 6, item G) (see instructions)........................................................

12.

12.

13.

Balance due (line 11 less line 12).......................................................................................................................................................

13.

Overpayment (line 12 less line 11)......................................................................................................................................................

14.

14.

15a. Interest (see instructions)..................................................................................................

15a.

15b. Additional charges (see instructions)................................................................................. 15b.

15c. Penalty for underpayment of estimated tax (attach Form NYC-222B)..............................

15c.

Total of lines 15a, 15b and 15c...........................................................................................................................................................

16.

16.

17.

Net overpayment (line 14 less line 16)................................................................................................................................................

17.

18.

Amount of line 17 to be:

(a) Refunded......................................................................................................................................... 18a.

(b) Credited to 2018 estimated tax....................................................................................................... 18b.

TOTAL REMITTANCE DUE (see instructions)...................................................................................................................................

19.

19.

%

Issuer's allocation percentage rounded to the nearest one hundredth of a percentage point (see instructions) (attach worksheet).....

20.

20.

Total receipts (Sch. G, part 1, line 2 , col. B)

22. Total assets from federal return................

21.

21.

22.

23.

Total capital from federal return.................. 23.

EIN of parent corporation........................... 24.

25. EIN of common parent corporation...........

24.

25.

n

Entire net income allocation percentage rounded to the nearest

26.

%

27. IBF Formula Allocation Method (3) 27.

one hundredth of a percentage point (Sch. G, part 1, line 7)

26.

............

28.

NYC rent deducted on federal tax return ...................................................................................................................................................................

28.

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Firm's Email Address:

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) ..YES

n

________________________________________

S

Preparer's Social Security Number or PTIN

IGN

Signature of officer

Title

Date

:

HERE

n

Preparer's

Preparer’s

Check if self-

employed 4

signature

printed name

Date

P

'

Firm's Employer Identification Number

REPARER

S

’

USE

ONLY

s Firm's name

s Address

s Zip Code

(or yours, if self-employed)

10011791

SEE PAGE 7 FOR MAILING INSTRUCTIONS

NYC-1 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7