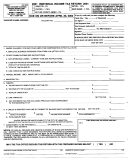

Form M1 - Individual Income Tax - 2017 Page 2

ADVERTISEMENT

2017 M1, page 2

*171122*

14

Tax on non-qualified first-time homebuyer withdrawals (enclose Schedule M1HOME) . . . . . . . . . . . . . . . . . . . . . 1 4

1 5

1 5

Tax before credits. Add lines 12, 13, and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Marriage Credit for joint return when both spouses have taxable earned income

1 6

or taxable retirement income (enclose Schedule M1MA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 7

17 Credit for taxes paid to another state (enclose Schedule(s) M1CR and M1RCR) . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Other nonrefundable credits (enclose Schedule M1C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 8

19 Total nonrefundable credits. Add lines 16, 17, and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 9

2 0

20 Subtract line 19 from line 15 (if result is zero or less, leave blank) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21 Nongame Wildlife Fund contribution (see instructions)

This will reduce your refund or increase the amount you owe . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 1

22 Add lines 20 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 2

23 Minnesota income tax withheld. Complete and enclose Schedule M1W to report

2 3

Minnesota withholding from W-2, 1099, and W-2G forms

(do not send)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 4

24 Minnesota estimated tax and extension payments made for 2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 Refundable credits (enclose Schedule M1REF): Child and Dependent Care Credit, Working Family Credit,

2 5

K-12 Education Credit, Credit for Parents of Stillborn Children, and Credit for Tax Paid to Wisconsin. . . . . . . . .

26

Business and investment credits (enclose Schedule M1B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 6

27

Total payments. Add lines 23 through 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 7

28

REFUND. If line 27 is more than line 22, subtract line 22 from line 27 (see instructions) .

For direct deposit, complete line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 8

Direct deposit of your refund (you must use an account not associated with a foreign bank):

29

Account Type

Routing Number

Account Number

Checking

Savings

30

AMOUNT YOU OWE. If line 22 is more than line 27, subtract

line 27 from line 22 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 0

Penalty amount from Schedule M15 (see instructions). Also subtract

31

3 1

this amount from line 28 or add it to line 30 (enclose Schedule M15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IF YOU PAY ESTIMATED TAX

and want part of your refund credited to estimated tax, complete lines 32 and 33.

3 2

32

Amount from line 28 you want sent to you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 3

33

Amount from line 28 you want applied to your 2018 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare that this return is correct and complete to the best of my knowledge and belief.

Paid preparer: You must sign below.

Paid preparer’s signature

Date

Your signature

Date

Taxpayer’s daytime phone

Spouse’s signature (if filing jointly)

Preparer’s daytime phone

PTIN or VITA/TCE # (required)

Your email address

Preparer’s email address

Include a copy of your 2017 federal return and schedules.

Mail to: Minnesota Individual Income Tax

I authorize the Minnesota Department of Revenue to

I do not want my paid

St. Paul, MN 55145-0010

discuss this return with my paid preparer or the

preparer to file my

To check on the status of your refund, visit

third-party designee indicated on my federal return.

return electronically.

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2