Instructions For Form 306 - Income Tax Withholding Return - State Of North Dakota

ADVERTISEMENT

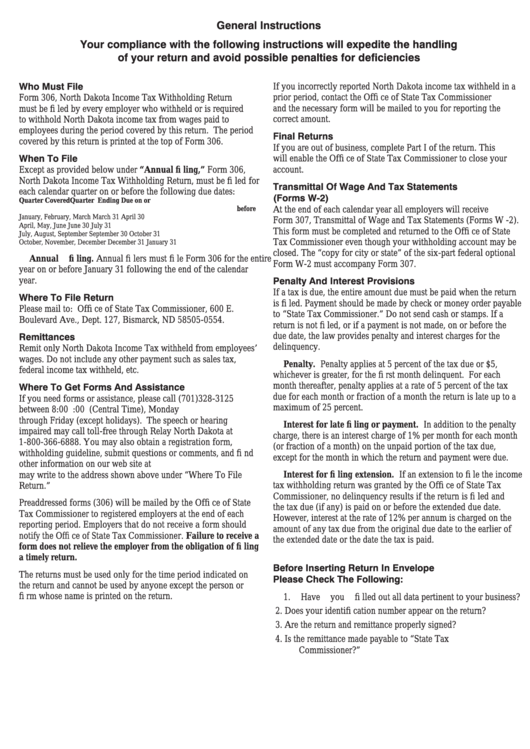

General Instructions

Your compliance with the following instructions will expedite the handling

of your return and avoid possible penalties for deficiencies

Who Must File

If you incorrectly reported North Dakota income tax withheld in a

Form 306, North Dakota Income Tax Withholding Return

prior period, contact the Offi ce of State Tax Commissioner

and the necessary form will be mailed to you for reporting the

must be fi led by every employer who withheld or is required

correct amount.

to withhold North Dakota income tax from wages paid to

employees during the period covered by this return. The period

Final Returns

covered by this return is printed at the top of Form 306.

If you are out of business, complete Part I of the return. This

When To File

will enable the Offi ce of State Tax Commissioner to close your

account.

Except as provided below under “Annual fi ling,” Form 306,

North Dakota Income Tax Withholding Return, must be fi led for

Transmittal Of Wage And Tax Statements

each calendar quarter on or before the following due dates:

(Forms W-2)

Quarter Covered

Quarter Ending

Due on or

At the end of each calendar year all employers will receive

before

January, February, March

March 31

April 30

Form 307, Transmittal of Wage and Tax Statements (Forms W -2).

April, May, June

June 30

July 31

This form must be completed and returned to the Offi ce of State

July, August, September

September 30

October 31

Tax Commissioner even though your withholding account may be

October, November, December

December 31

January 31

closed. The “copy for city or state” of the six-part federal optional

Annual fi ling. Annual fi lers must fi le Form 306 for the entire

Form W-2 must accompany Form 307.

year on or before January 31 following the end of the calendar

Penalty And Interest Provisions

year.

If a tax is due, the entire amount due must be paid when the return

Where To File Return

is fi led. Payment should be made by check or money order payable

Please mail to: Offi ce of State Tax Commissioner, 600 E.

to “State Tax Commissioner.” Do not send cash or stamps. If a

Boulevard Ave., Dept. 127, Bismarck, ND 58505-0554.

return is not fi led, or if a payment is not made, on or before the

Remittances

due date, the law provides penalty and interest charges for the

delinquency.

Remit only North Dakota Income Tax withheld from employees’

wages. Do not include any other payment such as sales tax,

Penalty. Penalty applies at 5 percent of the tax due or $5,

federal income tax withheld, etc.

whichever is greater, for the fi rst month delinquent. For each

Where To Get Forms And Assistance

month thereafter, penalty applies at a rate of 5 percent of the tax

due for each month or fraction of a month the return is late up to a

If you need forms or assistance, please call (701)328-3125

maximum of 25 percent.

between 8:00 a.m. and 5:00 p.m. (Central Time), Monday

through Friday (except holidays). The speech or hearing

Interest for late fi ling or payment. In addition to the penalty

impaired may call toll-free through Relay North Dakota at

charge, there is an interest charge of 1% per month for each month

1-800-366-6888. You may also obtain a registration form,

(or fraction of a month) on the unpaid portion of the tax due,

withholding guideline, submit questions or comments, and fi nd

except for the month in which the return and payment were due.

other information on our web site at Or you

Interest for fi ling extension. If an extension to fi le the income

may write to the address shown above under “Where To File

tax withholding return was granted by the Offi ce of State Tax

Return.”

Commissioner, no delinquency results if the return is fi led and

Preaddressed forms (306) will be mailed by the Offi ce of State

the tax due (if any) is paid on or before the extended due date.

Tax Commissioner to registered employers at the end of each

However, interest at the rate of 12% per annum is charged on the

reporting period. Employers that do not receive a form should

amount of any tax due from the original due date to the earlier of

notify the Offi ce of State Tax Commissioner. Failure to receive a

the extended date or the date the tax is paid.

form does not relieve the employer from the obligation of fi ling

a timely return.

Before Inserting Return In Envelope

The returns must be used only for the time period indicated on

Please Check The Following:

the return and cannot be used by anyone except the person or

fi rm whose name is printed on the return.

1. Have you fi lled out all data pertinent to your business?

2. Does your identifi cation number appear on the return?

3. Are the return and remittance properly signed?

4. Is the remittance made payable to “State Tax

Commissioner?”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1