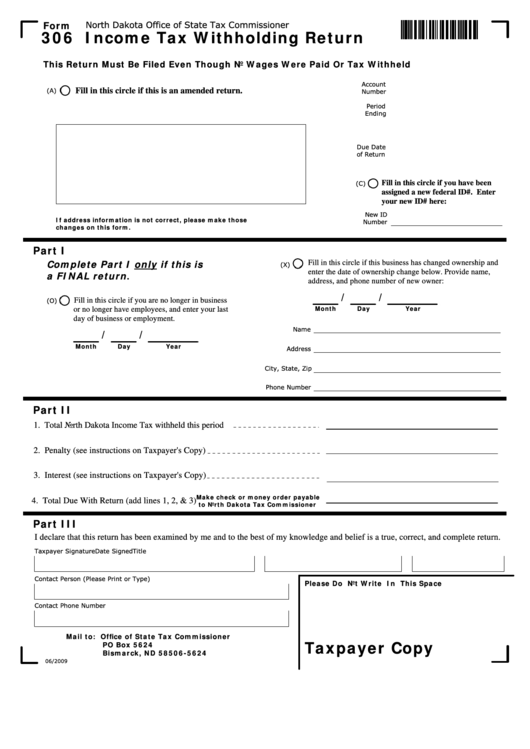

Form

North Dakota Office of State Tax Commissioner

306 Income Tax Withholding Return

This Return Must Be Filed Even Though No Wages Were Paid Or Tax Withheld

Account

(A)

Fill in this circle if this is an amended return.

Number

Period

Ending

Due Date

of Return

(C)

Fill in this circle if you have been

assigned a new federal ID#. Enter

your new ID# here:

New ID

If address information is not correct, please make those

Number

changes on this form.

Part I

Complete Part I only if this is

Fill in this circle if this business has changed ownership and

(X)

enter the date of ownership change below. Provide name,

a FINAL return

.

address, and phone number of new owner:

/

/

(O)

Fill in this circle if you are no longer in business

Month

Day

Year

or no longer have employees, and enter your last

day of business or employment.

Name

/

/

Month

Day

Year

Address

City, State, Zip

Phone Number

Part II

1. Total North Dakota Income Tax withheld this period

2. Penalty (see instructions on Taxpayer's Copy)

3. Interest (see instructions on Taxpayer's Copy)

Make check or money order payable

4. Total Due With Return (add lines 1, 2, & 3)

to North Dakota Tax Commissioner

Part III

I declare that this return has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Taxpayer Signature

Title

Date Signed

Contact Person (Please Print or Type)

Please Do Not Write In This Space

Contact Phone Number

Mail to: Office of State Tax Commissioner

Taxpayer Copy

PO Box 5624

Bismarck, ND 58506-5624

06/2009

1

1 2

2