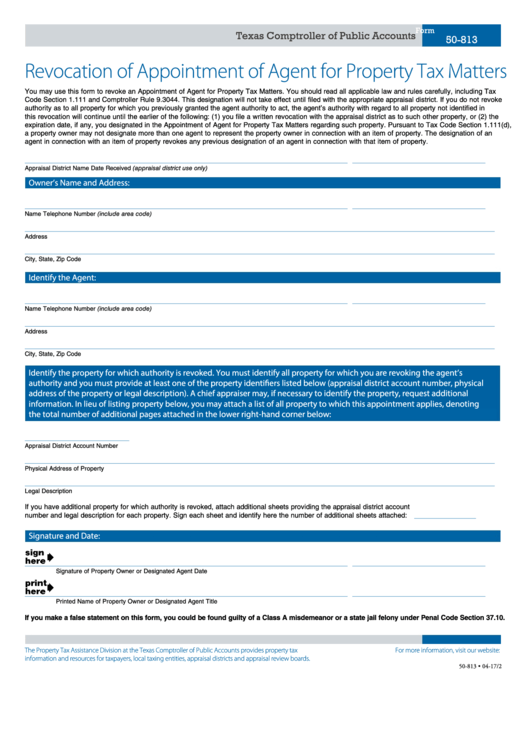

Form

Texas Comptroller of Public Accounts

50-813

Revocation of Appointment of Agent for Property Tax Matters

You may use this form to revoke an Appointment of Agent for Property Tax Matters. You should read all applicable law and rules carefully, including Tax

Code Section 1.111 and Comptroller Rule 9.3044. This designation will not take effect until filed with the appropriate appraisal district. If you do not revoke

authority as to all property for which you previously granted the agent authority to act, the agent’s authority with regard to all property not identified in

this revocation will continue until the earlier of the following: (1) you file a written revocation with the appraisal district as to such other property, or (2) the

expiration date, if any, you designated in the Appointment of Agent for Property Tax Matters regarding such property. Pursuant to Tax Code Section 1.111(d),

a property owner may not designate more than one agent to represent the property owner in connection with an item of property. The designation of an

agent in connection with an item of property revokes any previous designation of an agent in connection with that item of property.

____________________________________________________________________

____________________________

Appraisal District Name

Date Received (appraisal district use only)

Owner’s Name and Address:

____________________________________________________________________

____________________________

Name

Telephone Number (include area code)

___________________________________________________________________________________________________

Address

___________________________________________________________________________________________________

City, State, Zip Code

Identify the Agent:

____________________________________________________________________

____________________________

Name

Telephone Number (include area code)

___________________________________________________________________________________________________

Address

___________________________________________________________________________________________________

City, State, Zip Code

Identify the property for which authority is revoked. You must identify all property for which you are revoking the agent’s

authority and you must provide at least one of the property identifiers listed below (appraisal district account number, physical

address of the property or legal description). A chief appraiser may, if necessary to identify the property, request additional

information. In lieu of listing property below, you may attach a list of all property to which this appointment applies, denoting

the total number of additional pages attached in the lower right-hand corner below:

______________________

Appraisal District Account Number

___________________________________________________________________________________________________

Physical Address of Property

___________________________________________________________________________________________________

Legal Description

If you have additional property for which authority is revoked, attach additional sheets providing the appraisal district account

. . . . . . _____________

number and legal description for each property. Sign each sheet and identify here the number of additional sheets attached:

Signature and Date:

____________________________________________________________________

____________________________

Signature of Property Owner or Designated Agent

Date

____________________________________________________________________

____________________________

Printed Name of Property Owner or Designated Agent

Title

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37 .10.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-813 • 04-17/2

1

1