BOE-531-F (BACK) REV. 6 (4-08)

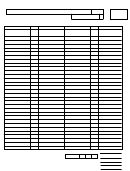

SCHEDULE F

DETAILED ALLOCATION BY CITY OF 1% COMBINED STATE

AND UNIFORM LOCAL SALES AND USE TAX

General: Schedule F is used by various industries to allocate the local sales and use tax to the proper jurisdiction pursuant to

the Revenue and Taxation Code. See below for the type of business for which you are reporting local tax.

Lessors of Motor Vehicles

Section 7205.1 of the Revenue and Taxation Code provides that lessors of motor vehicles must allocate the local tax due on

certain leases to the jurisdiction of the new motor vehicle dealer from whom the lessor acquired the leased vehicle on Schedule F.

The following chart summarizes the Schedule F reporting requirements for leases of motor vehicles* purchased from a new motor

vehicle dealer:

Leases Exceeding Four Months

Leases of Four Months or Less

Type of Lessor

Lessor's sales location

California lessor (other than a new motor vehicle

California dealer's sales location

dealer or "leasing company" as defined**)

(Schedule F)

Lessee's place of registration

Out-of-State lessor:

California dealer's sales location

(Schedule B)

(Schedule F)

* "Motor Vehicle" means any new or used self-propelled passenger vehicle other than a house, car, or pickup rated less than

one ton.

** "Leasing Company" means:

A motor vehicle dealer/lessor that originates lease contracts that are continuing sales and purchases and does not sell or

assign the lease contracts, and

The motor vehicle dealer/lessor has annual motor vehicle lease receipts of $15,000,000 or more per location.

Other Important Information Regarding Leases

Assigned Leases. The place of allocation will remain the same for the duration of the lease, even if the lessor sells the vehicle

and assigns the lease contract to a third party. Accordingly, if you are a lessor who assigns lease contracts to another lessor, you

are required to provide the lessor with copies of the original purchase contract for each vehicle and/or copies of prior schedules

showing how the use tax has been allocated.

Courtesy Deliveries. If a lease by an out-of-state lessor involves a courtesy delivery from an in-state inventory by a California

new motor vehicle dealer, the 1% combined state and local use tax on that lease should be allocated on Schedule F.

Special Tax Districts. Section 7205.1 does not affect the application of district taxes reported on Schedule A of your sales and

use tax return. The district use tax due on motor vehicle leases continues to be allocated to the place where the vehicle is

registered.

Purchases and/or Sales of $500,000 or More Subject to Use Tax

Persons Making Sales in Interstate Commerce to California Customers

Sales of goods delivered in interstate commerce with title to the property passing to a California purchaser at a point outside of

California are subject to 1% combined state and local use tax. For transactions of $500,000 or more, by sellers engaged in

business in California, the 1% combined state and local use tax should be allocated on Schedule F to the specific jurisdiction

where the first functional use of the property occurred. This is generally presumed to be the jurisdiction where the goods were

delivered. Sellers not engaged in business in California but who voluntarily collect and report use tax may report the 1%

combined state and local tax on transactions of $500,000 or more on Schedule F, but they are not required to do so.

Persons Making Ex-tax Purchases of $500,000 or More***

A person who purchases tangible personal property without payment of the 1% combined state and local use tax is liable for

the combined state and local tax on such purchases. If the purchase price is $500,000 or more, and the property is first

functionally used at a location for which a seller's permit is not required, the 1% combined state and local use tax should be

allocated on Schedule F. You can obtain a Schedule F and many other forms from the BOE website at

*** If the property is used at a location for which a seller's permit is not required, and is a purchase of less than $500,000,

report the amount on BOE 531, Schedule B, Detailed Allocation by County of the 1% Combined State and Uniform Local

Sales and Use Tax.

IF YOU HAVE QUESTIONS REGARDING THE COMPLETION OF THIS SCHEDULE,

PLEASE CONTACT OUR TAXPAYER INFORMATION SECTION AT 800-400-7115.

1

1 2

2