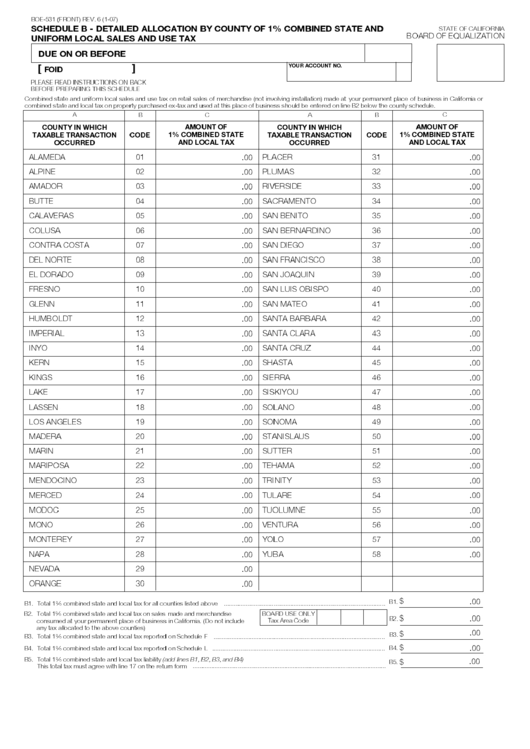

BOE-531 (FRONT) REV. 6 (1-07)

SCHEDULE B - DETAILED ALLOCATION BY COUNTY OF 1% COMBINED STATE AND

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

UNIFORM LOCAL SALES AND USE TAX

DUE ON OR BEFORE

FOID

YOUR ACCOUNT NO.

]

[

PLEASE READ INSTRUCTIONS ON BACK

BEFORE PREPARING THIS SCHEDULE

Combined state and uniform local sales and use tax on retail sales of merchandise (not involving installation) made at your permanent place of business in California or

combined state and local tax on property purchased ex-tax and used at this place of business should be entered on line B2 below the county schedule.

A

B

C

A

B

C

AMOUNT OF

COUNTY IN WHICH

AMOUNT OF

COUNTY IN WHICH

1% COMBINED STATE

1% COMBINED STATE

TAXABLE TRANSACTION

CODE

TAXABLE TRANSACTION

CODE

AND LOCAL TAX

OCCURRED

AND LOCAL TAX

OCCURRED

ALAMEDA

01

PLACER

31

.00

.00

ALPINE

02

PLUMAS

32

.00

.00

AMADOR

03

RIVERSIDE

33

.00

.00

BUTTE

04

SACRAMENTO

34

.00

.00

CALAVERAS

05

SAN BENITO

35

.00

.00

COLUSA

06

SAN BERNARDINO

36

.00

.00

CONTRA COSTA

07

.00

SAN DIEGO

37

.00

DEL NORTE

08

.00

SAN FRANCISCO

38

.00

EL DORADO

09

SAN JOAQUIN

39

.00

.00

FRESNO

10

SAN LUIS OBISPO

40

.00

.00

GLENN

11

SAN MATEO

41

.00

.00

HUMBOLDT

12

SANTA BARBARA

42

.00

.00

IMPERIAL

13

SANTA CLARA

43

.00

.00

INYO

14

SANTA CRUZ

44

.00

.00

KERN

15

.00

SHASTA

45

.00

KINGS

16

SIERRA

46

.00

.00

LAKE

17

.00

SISKIYOU

47

.00

LASSEN

18

SOLANO

48

.00

.00

LOS ANGELES

19

SONOMA

49

.00

.00

MADERA

20

STANISLAUS

50

.00

.00

MARIN

21

.00

SUTTER

51

.00

MARIPOSA

22

TEHAMA

52

.00

.00

MENDOCINO

23

.00

TRINITY

53

.00

MERCED

24

TULARE

54

.00

.00

MODOC

25

TUOLUMNE

55

.00

.00

MONO

26

VENTURA

56

.00

.00

MONTEREY

27

YOLO

57

.00

.00

NAPA

28

YUBA

58

.00

.00

NEVADA

29

.00

ORANGE

30

.00

$

.00

B1.

B1. Total 1% combined state and local tax for all counties listed above .................................................................................................

BOARD USE ONLY

B2. Total 1% combined state and local tax on sales made and merchandise

$

.00

B2.

consumed at your permanent place of business in California. (Do not include

Tax Area Code

any tax allocated to the above counties)

.00

$

B3.

B3. Total 1% combined state and local tax reported on Schedule F .......................................................................................................

$

B4.

.00

B4. Total 1% combined state and local tax reported on Schedule L ........................................................................................................

B5. Total 1% combined state and local tax liability

.00

$

B5.

(add lines B1, B2, B3, and B4)

....................................................................................................................

This total tax must agree with line 17 on the return form

1

1 2

2