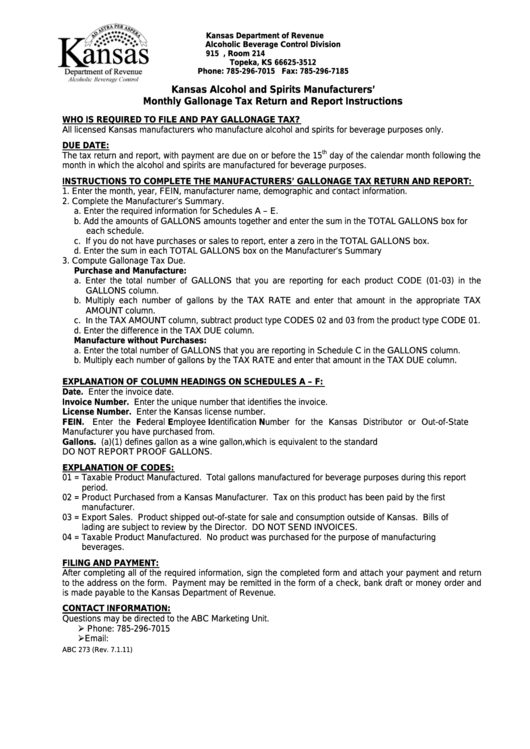

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 785-296-7185

Kansas Alcohol and Spirits Manufacturers’

Monthly Gallonage Tax Return and Report Instructions

WHO IS REQUIRED TO FILE AND PAY GALLONAGE TAX?

All licensed Kansas manufacturers who manufacture alcohol and spirits for beverage purposes only.

DUE DATE:

th

The tax return and report, with payment are due on or before the 15

day of the calendar month following the

month in which the alcohol and spirits are manufactured for beverage purposes.

INSTRUCTIONS TO COMPLETE THE MANUFACTURERS’ GALLONAGE TAX RETURN AND REPORT:

1. Enter the month, year, FEIN, manufacturer name, demographic and contact information.

2. Complete the Manufacturer’s Summary.

a. Enter the required information for Schedules A – E.

b. Add the amounts of GALLONS amounts together and enter the sum in the TOTAL GALLONS box for

each schedule.

c. If you do not have purchases or sales to report, enter a zero in the TOTAL GALLONS box.

d. Enter the sum in each TOTAL GALLONS box on the Manufacturer’s Summary

3. Compute Gallonage Tax Due.

Purchase and Manufacture:

a. Enter the total number of GALLONS that you are reporting for each product CODE (01-03) in the

GALLONS column.

b. Multiply each number of gallons by the TAX RATE and enter that amount in the appropriate TAX

AMOUNT column.

c. In the TAX AMOUNT column, subtract product type CODES 02 and 03 from the product type CODE 01.

d. Enter the difference in the TAX DUE column.

Manufacture without Purchases:

a. Enter the total number of GALLONS that you are reporting in Schedule C in the GALLONS column.

b. Multiply each number of gallons by the TAX RATE and enter that amount in the TAX DUE column.

EXPLANATION OF COLUMN HEADINGS ON SCHEDULES A – F:

Date. Enter the invoice date.

Invoice Number. Enter the unique number that identifies the invoice.

License Number. Enter the Kansas license number.

FEIN.

Enter the Federal Employee Identification Number for the Kansas Distributor or Out-of-State

Manufacturer you have purchased from.

Gallons. K.S.A. 41-501(a)(1) defines gallon as a wine gallon, which is equivalent to the standard U.S. gallon.

DO NOT REPORT PROOF GALLONS.

EXPLANATION OF CODES:

01 = Taxable Product Manufactured. Total gallons manufactured for beverage purposes during this report

period.

02 = Product Purchased from a Kansas Manufacturer. Tax on this product has been paid by the first

manufacturer.

03 = Export Sales. Product shipped out-of-state for sale and consumption outside of Kansas. Bills of

lading are subject to review by the Director. DO NOT SEND INVOICES.

04 = Taxable Product Manufactured. No product was purchased for the purpose of manufacturing

beverages.

FILING AND PAYMENT:

After completing all of the required information, sign the completed form and attach your payment and return

to the address on the form. Payment may be remitted in the form of a check, bank draft or money order and

is made payable to the Kansas Department of Revenue.

CONTACT INFORMATION:

Questions may be directed to the ABC Marketing Unit.

Phone: 785-296-7015

Email: ABC.Marketing.Unit@kdor.ks.gov

ABC 273 (Rev. 7.1.11)

1

1 2

2 3

3 4

4