Form Abc-1040 - Kansas Special Order Shipping Annual Gallonage Tax Return And Sales Report Instructions

ADVERTISEMENT

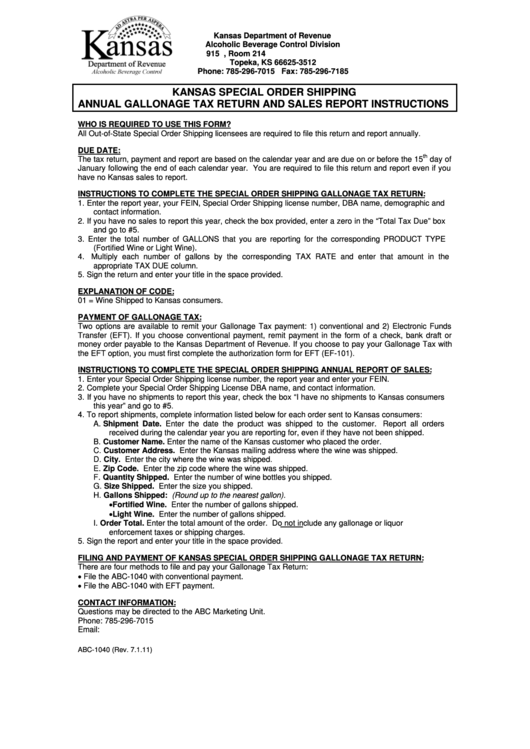

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 785-296-7185

KANSAS SPECIAL ORDER SHIPPING

ANNUAL GALLONAGE TAX RETURN AND SALES REPORT INSTRUCTIONS

WHO IS REQUIRED TO USE THIS FORM?

All Out-of-State Special Order Shipping licensees are required to file this return and report annually.

DUE DATE:

th

The tax return, payment and report are based on the calendar year and are due on or before the 15

day of

January following the end of each calendar year. You are required to file this return and report even if you

have no Kansas sales to report.

INSTRUCTIONS TO COMPLETE THE SPECIAL ORDER SHIPPING GALLONAGE TAX RETURN:

1.

Enter the report year, your FEIN, Special Order Shipping license number, DBA name, demographic and

contact information.

2.

If you have no sales to report this year, check the box provided, enter a zero in the “Total Tax Due” box

and go to #5.

3.

Enter the total number of GALLONS that you are reporting for the corresponding PRODUCT TYPE

(Fortified Wine or Light Wine).

4.

Multiply each number of gallons by the corresponding TAX RATE and enter that amount in the

appropriate TAX DUE column.

5.

Sign the return and enter your title in the space provided.

EXPLANATION OF CODE:

01 = Wine Shipped to Kansas consumers.

PAYMENT OF GALLONAGE TAX:

Two options are available to remit your Gallonage Tax payment: 1) conventional and 2) Electronic Funds

Transfer (EFT). If you choose conventional payment, remit payment in the form of a check, bank draft or

money order payable to the Kansas Department of Revenue. If you choose to pay your Gallonage Tax with

the EFT option, you must first complete the authorization form for EFT (EF-101).

INSTRUCTIONS TO COMPLETE THE SPECIAL ORDER SHIPPING ANNUAL REPORT OF SALES:

1.

Enter your Special Order Shipping license number, the report year and enter your FEIN.

2.

Complete your Special Order Shipping License DBA name, and contact information.

3.

If you have no shipments to report this year, check the box “I have no shipments to Kansas consumers

this year” and go to #5.

4.

To report shipments, complete information listed below for each order sent to Kansas consumers:

A.

Shipment Date. Enter the date the product was shipped to the customer. Report all orders

received during the calendar year you are reporting for, even if they have not been shipped.

B.

Customer Name. Enter the name of the Kansas customer who placed the order.

C. Customer Address. Enter the Kansas mailing address where the wine was shipped.

D. City. Enter the city where the wine was shipped.

E.

Zip Code. Enter the zip code where the wine was shipped.

F.

Quantity Shipped. Enter the number of wine bottles you shipped.

G. Size Shipped. Enter the size you shipped. i.e. 750 ml

H. Gallons Shipped: (Round up to the nearest gallon).

•

Fortified Wine. Enter the number of gallons shipped.

•

Light Wine. Enter the number of gallons shipped.

I.

Order Total. Enter the total amount of the order. Do not include any gallonage or liquor

enforcement taxes or shipping charges.

5.

Sign the report and enter your title in the space provided.

FILING AND PAYMENT OF KANSAS SPECIAL ORDER SHIPPING GALLONAGE TAX RETURN:

There are four methods to file and pay your Gallonage Tax Return:

•

File the ABC-1040 with conventional payment.

•

File the ABC-1040 with EFT payment.

CONTACT INFORMATION:

Questions may be directed to the ABC Marketing Unit.

Phone: 785-296-7015

Email: ABC.Marketing.Unit@kdor.ks.gov

ABC-1040 (Rev. 7.1.11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3