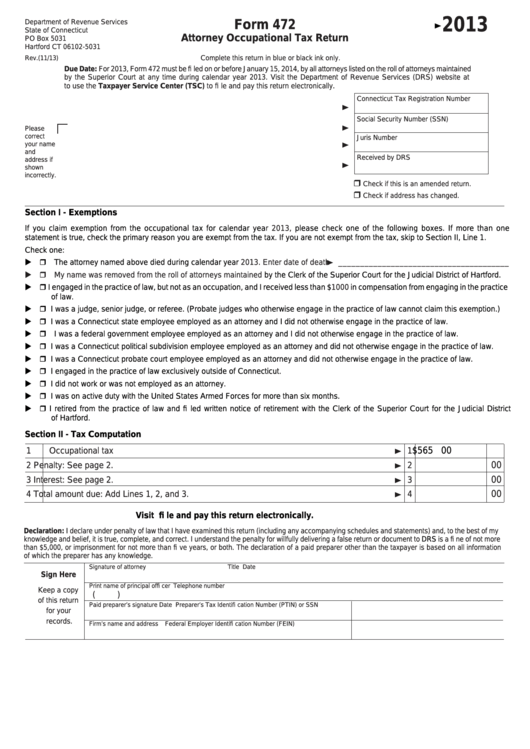

Form 472 - Attorney Occupational Tax Return - 2013

ADVERTISEMENT

2013

Form 472

Department of Revenue Services

State of Connecticut

Attorney Occupational Tax Return

PO Box 5031

Hartford CT 06102-5031

Complete this return in blue or black ink only.

Rev.(11/13)

Due Date: For 2013, Form 472 must be fi led on or before January 15, 2014, by all attorneys listed on the roll of attorneys maintained

by the Superior Court at any time during calendar year 2013. Visit the Department of Revenue Services (DRS) website at

to use the Taxpayer Service Center (TSC) to fi le and pay this return electronically.

Connecticut Tax Registration Number

Social Security Number (SSN)

Please

correct

Juris Number

your name

and

Received by DRS

address if

shown

incorrectly.

Check if this is an amended return.

Check if address has changed.

Section I - Exemptions

If you claim exemption from the occupational tax for calendar

year 2013,

please check one of the following boxes. If more than one

statement is true, check the primary reason you are exempt from the tax. If you are not exempt from the tax, skip to Section II, Line 1.

Check one:

The attorney named above died during calendar year

2013. Enter date of death

_______________________________________

My name was removed from the roll of attorneys maintained

by the Clerk of the Superior Court for the Judicial District of Hartford.

I engaged in the practice of law, but not as an occupation, and I received less than

$1000

in compensation from engaging in the practice

of law.

I was a judge, senior judge, or referee. (Probate judges who otherwise engage in the practice of law cannot claim this exemption.)

I was a Connecticut state employee employed as an attorney and I did not otherwise engage in the practice of law.

I was a federal government employee employed as an attorney and I did not otherwise engage in the practice of law.

I was a Connecticut political subdivision employee employed as an attorney and did not otherwise engage in the practice of law.

I was a Connecticut probate court employee employed as an attorney and did not otherwise engage in the practice of law.

I engaged in the practice of law exclusively outside of Connecticut.

I did not work or was not employed as an attorney.

I was on active duty with the United States Armed Forces for more than six months.

I retired from the practice of law and fi led written notice of retirement with the Clerk of the Superior Court for the Judicial District

of Hartford.

Section II - Tax Computation

$565 00

1

Occupational tax

1

00

2

Penalty: See page 2.

2

00

3

Interest: See page 2.

3

00

4

Total amount due: Add Lines 1, 2, and 3.

4

Visit to fi le and pay this return electronically.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to

DRS

is a fi ne of not more

than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Signature of attorney

Title

Date

Sign Here

Print name of principal offi cer

Telephone number

Keep a copy

(

)

of this return

Paid preparer’s signature

Date

Preparer’s Tax Identifi cation Number (PTIN) or SSN

for your

records.

Firm’s name and address

Federal Employer Identifi cation Number (FEIN)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3