Form Dr-534 - Application For Installment Payment Of Property Taxes

ADVERTISEMENT

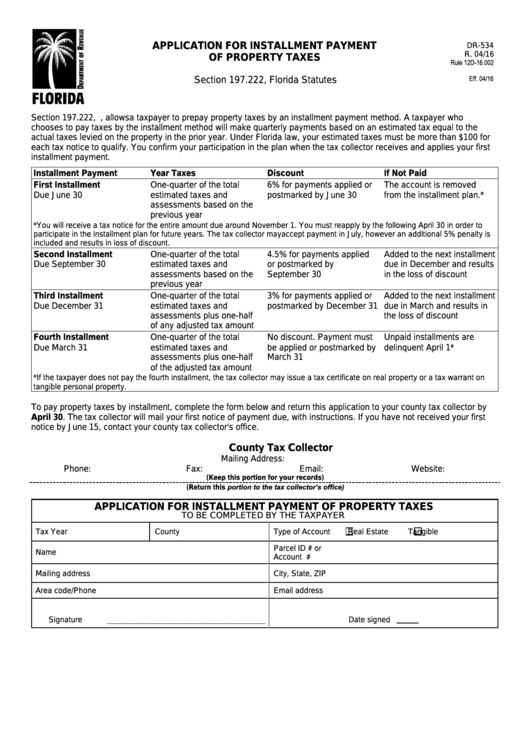

APPLICATION FOR INSTALLMENT PAYMENT

DR-534

R. 04/16

OF PROPERTY TAXES

Rule 12D-16.002

F.A.C.

Eff. 04/16

Section 197.222, Florida Statutes

Section 197.222, F.S., allows a taxpayer to prepay property taxes by an installment payment method. A taxpayer who

chooses to pay taxes by the installment method will make quarterly payments based on an estimated tax equal to the

actual taxes levied on the property in the prior year. Under Florida law, your estimated taxes must be more than $100 for

each tax notice to qualify. You confirm your participation in the plan when the tax collector receives and applies your first

installment payment.

Installment Payment

Year Taxes

Discount

If Not Paid

First Installment

One-quarter of the total

6% for payments applied or

The account is removed

Due June 30

estimated taxes and

postmarked by June 30

from the installment plan.*

assessments based on the

previous year

*You will receive a tax notice for the entire amount due around November 1. You must reapply by the following April 30 in order to

participate in the installment plan for future years. The tax collector may accept payment in July, however an additional 5% penalty is

included and results in loss of discount.

Second Installment

One-quarter of the total

4.5% for payments applied

Added to the next installment

Due September 30

estimated taxes and

or postmarked by

due in December and results

assessments based on the

September 30

in the loss of discount

previous year

Third Installment

One-quarter of the total

3% for payments applied or

Added to the next installment

Due December 31

estimated taxes and

postmarked by December 31

due in March and results in

assessments plus one-half

the loss of discount

of any adjusted tax amount

Fourth Installment

One-quarter of the total

No discount. Payment must

Unpaid installments are

Due March 31

estimated taxes and

be applied or postmarked by

delinquent April 1*

assessments plus one-half

March 31

of the adjusted tax amount

*If the taxpayer does not pay the fourth installment, the tax collector may issue a tax certificate on real property or a tax warrant on

tangible personal property.

To pay property taxes by installment, complete the form below and return this application to your county tax collector by

April 30. The tax collector will mail your first notice of payment due, with instructions. If you have not received your first

notice by June 15, contact your county tax collector's office.

County Tax Collector

Mailing Address:

Phone:

Fax:

Email:

Website:

(Keep this portion for your records)

(Return this portion to the tax collector’s office)

APPLICATION FOR INSTALLMENT PAYMENT OF PROPERTY TAXES

TO BE COMPLETED BY THE TAXPAYER

Tax Year

County

Type of Account

Real Estate

Tangible

Parcel ID # or

Name

Account #

Mailing address

City, State, ZIP

Area code/Phone

Email address

Signature

____________________________________

Date signed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1