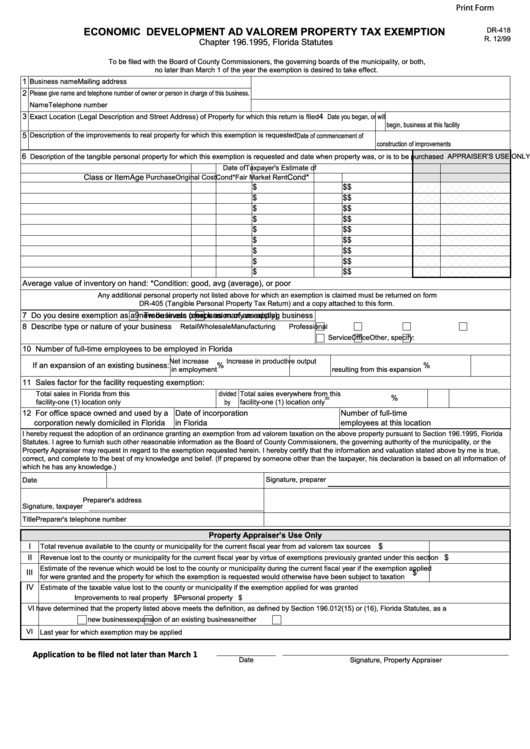

Print Form

ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION

DR-418

R. 12/99

Chapter 196.1995, Florida Statutes

To be filed with the Board of County Commissioners, the governing boards of the municipality, or both,

no later than March 1 of the year the exemption is desired to take effect.

1

Business name

Mailing address

2

Please give name and telephone number of owner or person in charge of this business.

Name

Telephone number

3

4

Exact Location (Legal Description and Street Address) of Property for which this return is filed

Date you began, or will

begin, business at this facility

5

Description of the improvements to real property for which this exemption is requested

Date of commencement of

construction of improvements

6

APPRAISER’S USE ONLY

Description of the tangible personal property for which this exemption is requested and date when property was, or is to be purchased

Date of

Taxpayer's Estimate of

Class or Item

Age

Cond*

Purchase

Original Cost

Cond*

Fair Market Rent

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Average value of inventory on hand:

*Condition: good, avg (average), or poor

Any additional personal property not listed above for which an exemption is claimed must be returned on form

DR-405 (Tangible Personal Property Tax Return) and a copy attached to this form.

7 Do you desire exemption as a

new business or

expansion of an existing business

9 Trade levels (check as many as apply)

8 Describe type or nature of your business

Retail

Wholesale

Manufacturing

Professional

Service

Office

Other, specify:

10 Number of full-time employees to be employed in Florida

Net increase

Increase in productive output

If an expansion of an existing business:

%

%

in employment

resulting from this expansion

11 Sales factor for the facility requesting exemption:

divided

Total sales in Florida from this

Total sales everywhere from this

=

%

by

facility-one (1) location only

facility-one (1) location only

12 For office space owned and used by a

Date of incorporation

Number of full-time

corporation newly domiciled in Florida

in Florida

employees at this location

I hereby request the adoption of an ordinance granting an exemption from ad valorem taxation on the above property pursuant to Section 196.1995, Florida

Statutes. I agree to furnish such other reasonable information as the Board of County Commissioners, the governing authority of the municipality, or the

Property Appraiser may request in regard to the exemption requested herein. I hereby certify that the information and valuation stated above by me is true,

correct, and complete to the best of my knowledge and belief. (If prepared by someone other than the taxpayer, his declaration is based on all information of

which he has any knowledge.)

Signature, preparer

Date

Preparer's address

Signature, taxpayer

Title

Preparer's telephone number

Property Appraiser’s Use Only

I

$

Total revenue available to the county or municipality for the current fiscal year from ad valorem tax sources

II

$

Revenue lost to the county or municipality for the current fiscal year by virtue of exemptions previously granted under this section

Estimate of the revenue which would be lost to the county or municipality during the current fiscal year if the exemption applied

III

$

for were granted and the property for which the exemption is requested would otherwise have been subject to taxation

IV

Estimate of the taxable value lost to the county or municipality if the exemption applied for was granted

Improvements to real property $

Personal property $

V

I have determined that the property listed above meets the definition, as defined by Section 196.012(15) or (16), Florida Statutes, as a

new business

expansion of an existing business

neither

VI Last year for which exemption may be applied

Application to be filed not later than March 1

Date

Signature, Property Appraiser

1

1 2

2