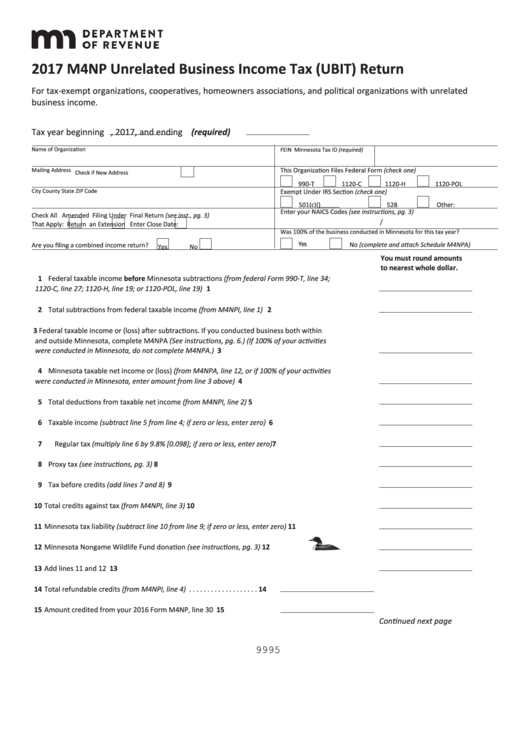

2017 M4NP Unrelated Business Income Tax (UBIT) Return

For tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated

business income .

Tax year beginning

, 2017, and ending

(required)

Name of Organization

Minnesota Tax ID (required)

FEIN

This Organization Files Federal Form (check one)

Mailing Address

Check if New Address

990-T

1120-C

1120-H

1120-POL

City

County

State

ZIP Code

Exempt Under IRS Section (check one)

501(c)(

)

528

Other:

Enter your NAICS Codes (see instructions, pg. 3)

Final Return (see inst., pg. 3)

Check All

Amended

Filing Under

/

That Apply:

Return

an Extension

Enter Close Date:

Was 100% of the business conducted in Minnesota for this tax year?

No (complete and attach Schedule M4NPA)

Yes

Are you filing a combined income return?

Yes

No

You must round amounts

to nearest whole dollar.

1 Federal taxable income before Minnesota subtractions (from federal Form 990-T, line 34;

1120-C, line 27; 1120-H, line 19; or 1120-POL, line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total subtractions from federal taxable income (from M4NPI, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Federal taxable income or (loss) after subtractions. If you conducted business both within

and outside Minnesota, complete M4NPA (See instructions, pg. 6.) (If 100% of your activities

were conducted in Minnesota, do not complete M4NPA.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Minnesota taxable net income or (loss) (from M4NPA, line 12, or if 100% of your activities

were conducted in Minnesota, enter amount from line 3 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total deductions from taxable net income (from M4NPI, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Taxable income (subtract line 5 from line 4; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Regular tax (multiply line 6 by 9.8% [0.098]; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . .7

8 Proxy tax (see instructions, pg. 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Tax before credits (add lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total credits against tax (from M4NPI, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Minnesota tax liability (subtract line 10 from line 9; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . 11

12 Minnesota Nongame Wildlife Fund donation (see instructions, pg. 3) . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total refundable credits (from M4NPI, line 4) . . . . . . . . . . . . . . . . . . . 14

15 Amount credited from your 2016 Form M4NP, line 30 . . . . . . . . . . . 15

Continued next page

9995

1

1 2

2 3

3 4

4