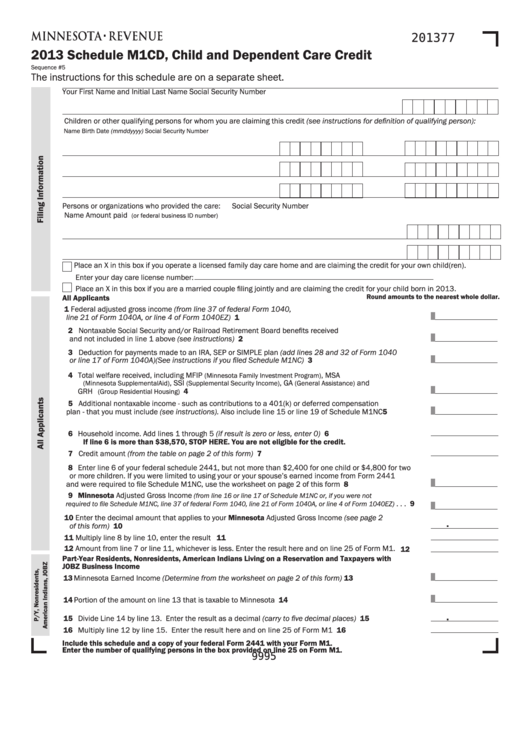

201377

2013 Schedule M1CD, Child and Dependent Care Credit

Sequence #5

The instructions for this schedule are on a separate sheet.

Your First Name and Initial

Last Name

Social Security Number

Children or other qualifying persons for whom you are claiming this credit (see instructions for definition of qualifying person):

Name

Birth Date (mmddyyyy)

Social Security Number

Persons or organizations who provided the care:

Social Security Number

Name

Amount paid

(or federal business ID number)

Place an X in this box if you operate a licensed family day care home and are claiming the credit for your own child(ren).

Enter your day care license number:

.

Place an X in this box if you are a married couple filing jointly and are claiming the credit for your child born in 2013

Round amounts to the nearest whole dollar.

All Applicants

1 Federal adjusted gross income (from line 37 of federal Form 1040,

line 21 of Form 1040A, or line 4 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Nontaxable Social Security and/or Railroad Retirement Board benefits received

and not included in line 1 above (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Deduction for payments made to an IRA, SEP or SIMPLE plan (add lines 28 and 32 of Form 1040

or line 17 of Form 1040A)(See instructions if you filed Schedule M1NC) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total welfare received, including MFIP

, MSA

(Minnesota Family Investment Program)

, SSI

, GA

and

(Minnesota Supplemental Aid)

(Supplemental Security Income)

(General Assistance)

GRH

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

(Group Residential Housing)

5 Additional nontaxable income - such as contributions to a 401(k) or deferred compensation

plan - that you must include (see instructions) . Also include line 15 or line 19 of Schedule M1NC . . . . . . .5

6 Household income. Add lines 1 through 5 (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . 6

If line 6 is more than $38,570, STOP HERE. You are not eligible for the credit.

7 Credit amount (from the table on page 2 of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Enter line 6 of your federal schedule 2441, but not more than $2,400 for one child or $4,800 for two

or more children. If you were limited to using your or your spouse’s earned income from Form 2441

and were required to file Schedule M1NC, use the worksheet on page 2 of this form . . . . . . . . . . . . . . . . . 8

9 Minnesota Adjusted Gross Income

(from line 16 or line 17 of Schedule M1NC or, if you were not

. . . 9

required to file Schedule M1NC, line 37 of federal Form 1040, line 21 of Form 1040A, or line 4 of Form 1040EZ)

10 Enter the decimal amount that applies to your Minnesota Adjusted Gross Income (see page 2

.

of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Multiply line 8 by line 10, enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Amount from line 7 or line 11, whichever is less. Enter the result here and on line 25 of Form M1. . . . . 12

Part-Year Residents, Nonresidents, American Indians Living on a Reservation and Taxpayers with

JOBZ Business Income

13 Minnesota Earned Income (Determine from the worksheet on page 2 of this form) . . . . . . . . . . . . . . . . . 13

14 Portion of the amount on line 13 that is taxable to Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.

15 Divide Line 14 by line 13. Enter the result as a decimal (carry to five decimal places) . . . . . . . . . . . . . . 15

16 Multiply line 12 by line 15. Enter the result here and on line 25 of Form M1 . . . . . . . . . . . . . . . . . . . 16

Include this schedule and a copy of your federal Form 2441 with your Form M1.

Enter the number of qualifying persons in the box provided on line 25 on Form M1.

9995

1

1 2

2 3

3 4

4