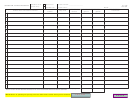

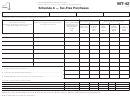

Form Mt-42 - Schedule A - Tax-Free Purchases Page 2

ADVERTISEMENT

MT-42 (9/09) (back)

Instructions

Complete this form and attach it to Form MT-40, Return of Tax on Wines, Liquors, Alcohol, and Distilled or Rectified Spirits.

Read Form MT-40-I, Instructions for Form MT-40, before completing this schedule.

• Report all your purchases of alcoholic beverages during the filing period on which you did not pay the New York State

alcoholic beverages tax.

• Report net total purchases and returns from each source as one item.

– Add returns of alcoholic beverages received from your customers on which the New York State alcoholic beverages

tax was not paid.

– Deduct all alcoholic beverages that you returned to your dealer for credit if they were originally purchased tax free in

New York State.

• Report withdrawals from bonded warehouses, listing each withdrawal separately by release number and name of

warehouse.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2