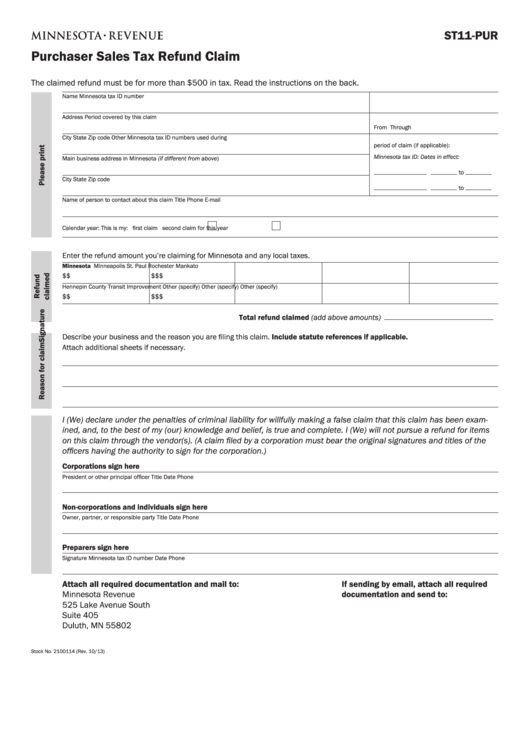

ST11-PUR

Purchaser Sales Tax Refund Claim

The claimed refund must be for more than $500 in tax. Read the instructions on the back.

Name

Minnesota tax ID number

Address

Period covered by this claim

From

Through

City

State

Zip code

Other Minnesota tax ID numbers used during

period of claim (if applicable):

Minnesota tax ID:

Dates in effect:

Main business address in Minnesota (if different from above)

to

City

State

Zip code

to

Name of person to contact about this claim

Title

Phone

E-mail

Calendar year:

This is my:

first claim

second claim for this year

Enter the refund amount you’re claiming for Minnesota and any local taxes.

Minneapolis

St. Paul

Rochester

Mankato

Minnesota

$

$

$

$

$

Hennepin County

Transit Improvement

Other (specify)

Other (specify)

Other (specify)

$

$

$

$

$

Total refund claimed (add above amounts)

Describe your business and the reason you are filing this claim. Include statute references if applicable.

Attach additional sheets if necessary.

I (We) declare under the penalties of criminal liability for willfully making a false claim that this claim has been exam-

ined, and, to the best of my (our) knowledge and belief, is true and complete. I (We) will not pursue a refund for items

on this claim through the vendor(s). (A claim filed by a corporation must bear the original signatures and titles of the

officers having the authority to sign for the corporation.)

Corporations sign here

President or other principal officer

Title

Date

Phone

Non-corporations and individuals sign here

Owner, partner, or responsible party

Title

Date

Phone

Preparers sign here

Signature

Minnesota tax ID number

Date

Phone

Attach all required documentation and mail to:

If sending by email, attach all required

Minnesota Revenue

documentation and send to:

525 Lake Avenue South

salesuse.claim@state.mn.us

Suite 405

Duluth, MN 55802

Stock No. 2100114 (Rev. 10/13)

1

1 2

2 3

3 4

4