MT-15 (8/14) Page 3 of 4

15

Total from page 2

(add lines 2, 3, 12, and 14 on page 2)

.................................................................................... 15.

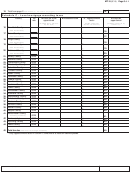

Schedule C - Local mortgage recording taxes

*

Locality

Tax

A Local tax to be

B Assessed value

C

Apportionment

D Local tax

rate

apportioned

factor

apportioned

(multiply line 1 amount

(divide column B

(multiply column A by

by tax rate)

by line 10 amount)

column C)

16

New York County

(see instructions)

16.

17

Bronx County

(see instructions)

17.

18

Kings County

(see instructions)

18.

19

Queens County

(see instructions)

19.

20

Richmond County

(see instructions)

20.

21

Albany County

.0025

21.

22

Broome County

.0025

22.

23

Cattaraugus County

.0025

23.

24

Chautauqua County

.0025

24.

25

Columbia County

.0050

25.

26

Cortland County

.0025

26.

27

Essex County

.0025

27.

28

Genesee County

.0025

28.

29

Greene County

.0050

29.

30

Hamilton County

.0025

30.

31

Herkimer County

.0025

31.

32

Lewis County

.0025

32.

33

Rensselaer County

.0025

33.

34

Rockland County

.0025

34.

35

Schenectady County

.0025

35.

36

Schoharie County

.0025

36.

37

Steuben County

.0025

37.

38

Sullivan County

.0025

38.

39

Warren County

.0025

39.

40

Wayne County

.0025

40.

41

Westchester County

(including Yonkers)

.0025

41.

42

Yonkers (city)

.0050

42.

43

Wyoming County

.0025

43.

44

Yates County

.0025

44.

45

Total tax due

(add lines 15 through 44 above)

45.

*

Carry apportionment factor in column C amounts to at least six decimal places.

Signature of preparer

Date

1

1 2

2 3

3 4

4