absent the credit by a ratio, the numerator of which is an

property not been included in the numerator of the ratio

amount equal to the lesser of the amount of natural resource

used to calculate the natural resource credit, multiplied by

property or $7.5 million, and the denominator of which is an

[(five minus the number of years the property was used as

amount equal to the total adjusted gross estate.

natural resource property) divided by five]. The property

owner will pay the additional tax at the time of the dis-

Example: If an estate had a adjusted gross estate of $2

position of the property or the disqualifying event. Each

million, natural resource property of $1.2 million and tax

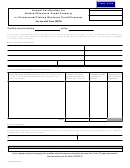

property owner will need to file Form OR706-A, Additional

payable to Oregon of $101,250, the credit would be $60,750,

Oregon Estate Transfer Tax Return, 150-104-007. This return

computed as follows:

and the additional tax are due six months after the date of

101,250 x (1,200,000 ÷ 2,000,000) = 60,750

disposition of the property. For examples of the additional

tax due, see Form OR706-A and instructions.

Annual certification for natural resource

• The payment of federal estate taxes, state inheritance, or

estate taxes from cash or other assets for which a natural

credit [

ORS 118.140(10)]

resource credit was claimed, shall be a disposition and an

additional tax shall be imposed.

The heir who inherits the natural resource property will

need to file the Annual Certification for Natural Resource Credit

• The conveyance after the decedent’s death of property

Property or Commercial Fishing Business Credit Property form,

that otherwise meets the requirements of this section

150-104-008, with us. This form certifies the heir’s continued

and is conveyed as a qualified conservation contribution

[IRC 170(h)], is not a disposition requiring payment of

qualified use of the property, this form is due April 15th.

additional tax under this subsection.

Disposition of natural resource property

• Natural resource property may be replaced with real

property or personal property after the credit is claimed

and additional tax due

[ORS 118.140(9)(a)]

and does not result in a disposition subject to an addition-

al tax if the replacement property is used in the operation

An additional tax may be imposed per ORS 118.005 to

of the farm business, forestry business, or fishing busi-

118.540 if the natural resource property or commercial fish-

ness. Real property for which a credit is claimed under

ing business property is disposed of or is transferred to a

this section may be replaced only with real property that

person other than a family member or another eligible entity,

would otherwise qualify as natural resource property.

before the property is used for five out of eight years after

The replacement must be made within one year to avoid

the date of death.

a disposition and additional tax, with the exception that

The additional tax liability is the amount of the additional

involuntarily converted replacement property must occur

tax that would have been imposed, had the disqualified

within two years (IRC 1033).

150-104-003 (Rev. 07-14)

Instructions for Schedule NRC for Form OR706, page 2 of 5

1

1 2

2 3

3 4

4 5

5