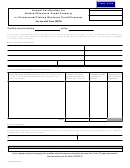

Oregon Natural Resource or Commercial Fishing Business Property Credit for Form OR706

Estate of:

Decedent’s Social Security number

Part 5

. Adjusted gross estate and credit computation

Adjusted gross estate:

1. Gross estate (Form OR706, part 2, line 1) .................................................................... 1.

$

2. Less:

a. Schedules J and K (Form OR706, part 5, line 516) ............................................... 2a.

b. Schedule L (Form OR706, part 5, line 518) ........................................................... 2b.

3. Adjusted gross estate (subtract the result of 2a plus 2b from line 1) .............................................................................. 3.

Stop if this amount is more than $15 million; you do not qualify for the credit.

4. Value of all eligible natural resource or fishing property. Real property must be

in Oregon (Schedule NRC, part 2, column C total) ................................................... 4.

5. Divide line 4 by line 3. This is your natural resource property percentage ................... 5.

%

Stop if your percentage is less than 50 percent; you do not qualify for the credit.

6. Value of natural resource property on which the credit is calculated

(Schedule NRC, part 2, column D total, do not enter more than $7.5 million) ......................................................... 6.

7. Divide line 6 by line 3 (round to two decimal places) ...................................................................................................... 7.

8. Estate tax payable to Oregon (Form OR706, part 2, Line 7) ........................................................................................... 8. $

9. Multiply line 8 by line 7. This is your natural resource credit. Enter on Form OR706, part 2, line 8 ................................ 9.

Example:

The John Doe Estate has a gross estate of $4,225,000, Schedule J and K expenses of $135,000,

Schedule L expenses of $90,000, and adjusted gross estate of $4,000,000. The value of natural

resource property (Schedule NRC, part 2, column D) is $2,500,000 and the estate tax payable (Form

OR706, part 2, Line 7) is $312,500. Here is the computation of the credit:

Line 1...........................$ 4,225,000

Line 2a. ........................$

135,000

Line 2b. .......................$

90,000

Line 3...........................$ 4,000,000

Line 4...........................$ 2,500,000

LIne 5 ...................................... 0.63

Line 6...........................$ 2,500,000

Line 7....................................... 0.63

Line 8...........................$

312,500

Line 9 ..........................$

196,875

Attach pages 1, 2 and 3 of this schedule to Form OR706 and

provide a complete copy of Schedule NRC to each qualified heir identified in part 3.

150-104-003 (Rev. 07-14)

Schedule NRC for Form OR706, page 5 of 5

1

1 2

2 3

3 4

4 5

5