Form Fit-20 - Financial Institution Tax Booklet - 2013 Page 25

ADVERTISEMENT

Department of Revenue

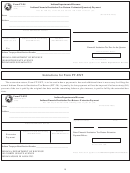

Schedule FIT-NRTC

Indiana Financial Institution

State Form 44625

(R12/8-13)

Nonresident Tax Credit

(See instructions on page 20)

Name of Corporation

Federal Identification Number

Part I: Identification Section

Column A

Column B

Column C

Name of Borrower

Principal Amount of Loan

Receipts Attributed to Loan

$

$

Totals

Part II: Calculation Section

1. Enter the total receipts from Part I ...................................................................................

1

2. Enter the total receipts attributable to nonresident ..........................................................

2

%

3. Divide line 1 by line 2. Express as a percentage (i.e., .5086 = 50.86%) ..........................

3

.

4. Enter the amount of tax attributable to nonresident (from a pro forma schedule) ............

4

5. Multiply the percentage from line 3 by the amount on line 4 ............................................

5

6. Enter the amount of taxes paid to your state of commercial domicile for the qualified

loans listed in Part I ..........................................................................................................

6

7. Enter the lesser of the amounts from lines 5 and 6. Enter this amount on line 28

of Form FIT-20 .................................................................................................................

7

*24100000000*

24100000000

23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30