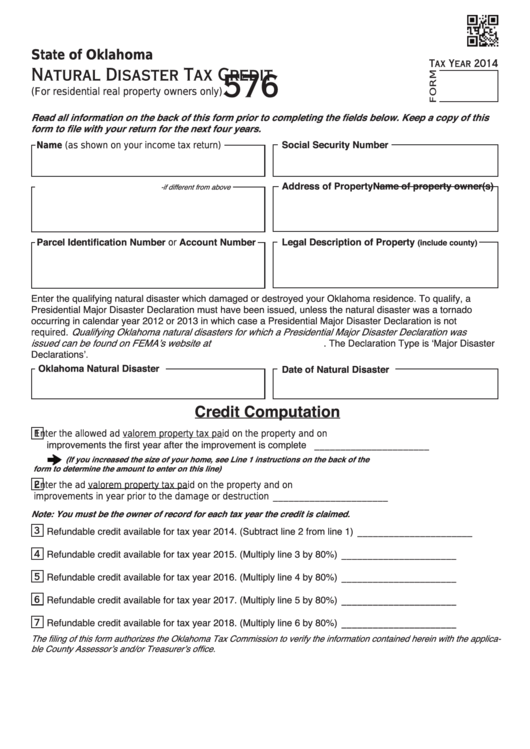

State of Oklahoma

Tax Year 2014

Natural Disaster Tax Credit

576

(For residential real property owners only)

Read all information on the back of this form prior to completing the fields below. Keep a copy of this

form to file with your return for the next four years.

Social Security Number

Name (as shown on your income tax return)

Name of property owner(s)

Address of Property

-if different from above

Parcel Identification Number or Account Number

Legal Description of Property

(include county)

Enter the qualifying natural disaster which damaged or destroyed your Oklahoma residence. To qualify, a

Presidential Major Disaster Declaration must have been issued, unless the natural disaster was a tornado

occurring in calendar year 2012 or 2013 in which case a Presidential Major Disaster Declaration is not

Qualifying Oklahoma natural disasters for which a Presidential Major Disaster Declaration was

required.

issued can be found on FEMA’s website at

. The Declaration Type is ‘Major Disaster

Declarations’.

Oklahoma Natural Disaster

Date of Natural Disaster

Credit Computation

1

Enter the allowed ad valorem property tax paid on the property and on

improvements the first year after the improvement is complete ........................ ______________________

(If you increased the size of your home, see Line 1 instructions on the back of the

form to determine the amount to enter on this line)

2

Enter the ad valorem property tax paid on the property and on

improvements in year prior to the damage or destruction .................................. ______________________

Note: You must be the owner of record for each tax year the credit is claimed.

Refundable credit available for tax year 2014. (Subtract line 2 from line 1) ....... ______________________

3

Refundable credit available for tax year 2015. (Multiply line 3 by 80%) ............. ______________________

4

Refundable credit available for tax year 2016. (Multiply line 4 by 80%) ............. ______________________

5

Refundable credit available for tax year 2017. (Multiply line 5 by 80%) ............. ______________________

6

Refundable credit available for tax year 2018. (Multiply line 6 by 80%) ............. ______________________

7

The filing of this form authorizes the Oklahoma Tax Commission to verify the information contained herein with the applica-

ble County Assessorʼs and/or Treasurerʼs office.

1

1 2

2