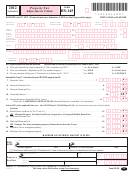

*171441200*

Claimant’s Last Name

Social Security Number

* 1 7 1 4 4 1 2 0 0 *

1. Claimant and jointly

2. Filing separately

3. Other Persons

filed Spouse

Spouse or CU Partner

$

$

$

1. Amount from Line n, Column 1

2. Amount from Line n, Column 2

3. Amount from Line n, Column 3

o. See instructions Enter Social Security and Medicare

tax withheld on wages claimed on Line d. Self-Employed:

Enter self-employment tax from Federal Schedule SE.

This entry may differ from W-2/1099 or Federal

Schedule SE amount if these taxes are paid on

income not required to be reported on Schedule

HI-144. Include W-2 and/or Federal Schedule SE

.0 0

.0 0

.0 0

if not included with income tax filing. . . . . . . . . .o. ________________________

________________________

________________________

p. Child support paid. You must include proof

.0 0

.0 0

.0 0

of payment. See instructions. . . . . . . . . . . . . . . . p. ________________________

________________________

________________________

Support paid to: Last Name

First Name

Initial

Social Security Number

q. Allowable adjustments from Federal Form 1040 or 1040A

q1. Business Expenses for Reservists

.0 0

.0 0

.0 0

(1040, Line 24) . . . . . . . . . . . . . . . . . . q1. ________________________

________________________

________________________

.0 0

.0 0

.0 0

q2. Alimony paid (1040, Line 31a) . . . . . . q2. ________________________

________________________

________________________

q3. Tuition and fees (1040, Line 34 or

.0 0

.0 0

.0 0

1040A, Line 19) . . . . . . . . . . . . . . . . . q3. ________________________

________________________

________________________

q4. Self-employed health insurance

.0 0

.0 0

.0 0

deduction (1040, Line 29) . . . . . . . . . . q4. ________________________

________________________

________________________

q5. Health Savings Account deduction

.0 0

.0 0

.0 0

(1040, Line 25) . . . . . . . . . . . . . . . . . . q5. ________________________

________________________

________________________

r. Add Lines o, p and total of Lines q1 to q5 for

.0 0

.0 0

.0 0

each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . .r. ________________________

________________________

________________________

s. Subtract Line r from Line n of each column.

.0 0

.0 0

.0 0

If a negative amount, enter -0- . . . . . . . . . . . . . . . s. ________________________

________________________

________________________

.0 0

t. Add all three amounts from Line s. If a negative amount, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . t. ________________________

u. Complete if born Jan. 1, 1953, and after.

Enter interest and dividend income from

.0 0

.0 0

.0 0

Lines e and f . . . . . . . . . . . . . . . . . . . . . . . . . . . . u. ________________________

________________________

________________________

.0 0

v. Add all three amounts from Line u . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . v. ________________________

10000.0 0

w. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . w. ________________________

.0 0

x. Subtract Line w from Line v. If Line w is more than Line v, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . x. ________________________

.0 0

HOUSEHOLD INCOME.

y.

Add Line t and Line x. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . y. ________________________

RENTERS:

If Line y Household Income is $47,000 or less, you may be eligible for a renter rebate. Complete Form PR-141. This schedule must

be filed with the Renter Rebate Claim. Claims are due April 17, 2018, but can be filed up to Oct. 15, 2018.

If Household Income is more than $47,000, you do not qualify for a renter rebate.

HOMEOWNERS:

Form HS-122, Homestead Declaration AND Property Tax Adjustment Claim, must be filed each year.

Homeowners with Household Income up to $147,500 on Line y should complete Form HS-122, Section B. You may be eligible for

a property tax adjustment. This schedule must be filed with the HS-122.

Form HS-122 Due Date - April 17, 2018. Homeowners filing a property tax adjustment, Forms HS-122 and HI-144, between

April 18 and Oct. 15, 2018, may still qualify for a property tax adjustment. A $15 late filing fee will be deducted from the adjustment.

5454

Schedule HI-144, page 2 of 2

32

1

1 2

2 3

3 4

4