Form Ow-8-Esc - Tax Worksheet For Corporations And Trusts

ADVERTISEMENT

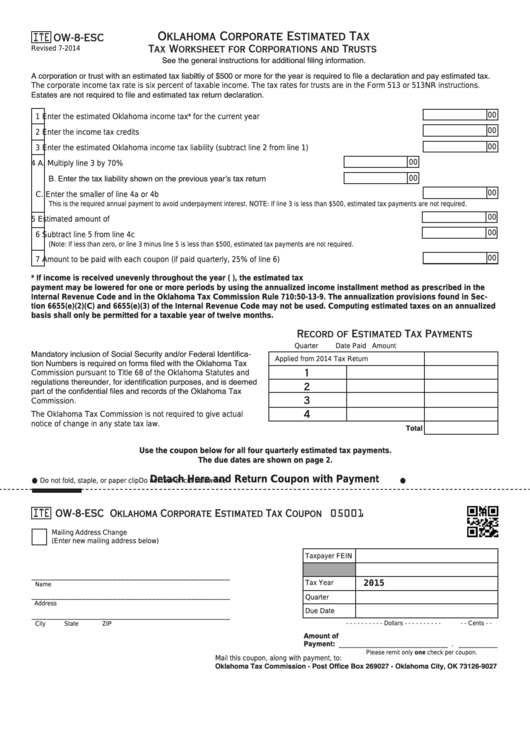

Oklahoma Corporate Estimated Tax

ITE OW-8-ESC

Tax Worksheet for Corporations and Trusts

Revised 7-2014

See the general instructions for additional filing information.

A corporation or trust with an estimated tax liabiltiy of $500 or more for the year is required to file a declaration and pay estimated tax.

The corporate income tax rate is six percent of taxable income. The tax rates for trusts are in the Form 513 or 513NR instructions.

Estates are not required to file and estimated tax return declaration.

00

1

Enter the estimated Oklahoma income tax* for the current year .......................................................................

00

2

Enter the income tax credits ..............................................................................................................................

00

3

Enter the estimated Oklahoma income tax liability (subtract line 2 from line 1) ................................................

00

4

A. Multiply line 3 by 70%..............................................................................................

00

B. Enter the tax liability shown on the previous year’s tax return ................................

00

C. Enter the smaller of line 4a or 4b .................................................................................................................

This is the required annual payment to avoid underpayment interest. NOTE: If line 3 is less than $500, estimated tax payments are not required.

00

5

Estimated amount of withholding.......................................................................................................................

00

6

Subtract line 5 from line 4c ................................................................................................................................

(Note: If less than zero, or line 3 minus line 5 is less than $500, estimated tax payments are not required.

00

7

Amount to be paid with each coupon (if paid quarterly, 25% of line 6) ..............................................................

* If income is received unevenly throughout the year (e.g. operating a business on a seasonal basis), the estimated tax

payment may be lowered for one or more periods by using the annualized income installment method as prescribed in the

Internal Revenue Code and in the Oklahoma Tax Commission Rule 710:50-13-9. The annualization provisions found in Sec-

tion 6655(e)(2)(C) and 6655(e)(3) of the Internal Revenue Code may not be used. Computing estimated taxes on an annualized

basis shall only be permitted for a taxable year of twelve months.

Record of Estimated Tax Payments

Quarter

Date Paid

Amount

Mandatory inclusion of Social Security and/or Federal Identifica-

Applied from 2014 Tax Return ............................

tion Numbers is required on forms filed with the Oklahoma Tax

1

Commission pursuant to Title 68 of the Oklahoma Statutes and

regulations thereunder, for identification purposes, and is deemed

2

part of the confidential files and records of the Oklahoma Tax

3

Commission.

The Oklahoma Tax Commission is not required to give actual

4

notice of change in any state tax law.

Total

Use the coupon below for all four quarterly estimated tax payments.

The due dates are shown on page 2.

Do not fold, staple, or paper clip

Detach Here and Return Coupon with Payment

Do not tear or cut below line

OW-8-ESC Oklahoma Corporate Estimated Tax Coupon

ITE

05001

Mailing Address Change

(Enter new mailing address below)

Taxpayer FEIN

___________________________________________________

Tax Year

2015

Name

Quarter

___________________________________________________

Address

Due Date

___________________________________________________

- - - - - - - - - - Dollars - - - - - - - - - -

- - Cents - -

City

State

ZIP

Amount of

____________________________ . __________

Payment:

Please remit only one check per coupon.

Mail this coupon, along with payment, to:

Oklahoma Tax Commission - Post Office Box 269027 - Oklahoma City, OK 73126-9027

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2