*171191100*

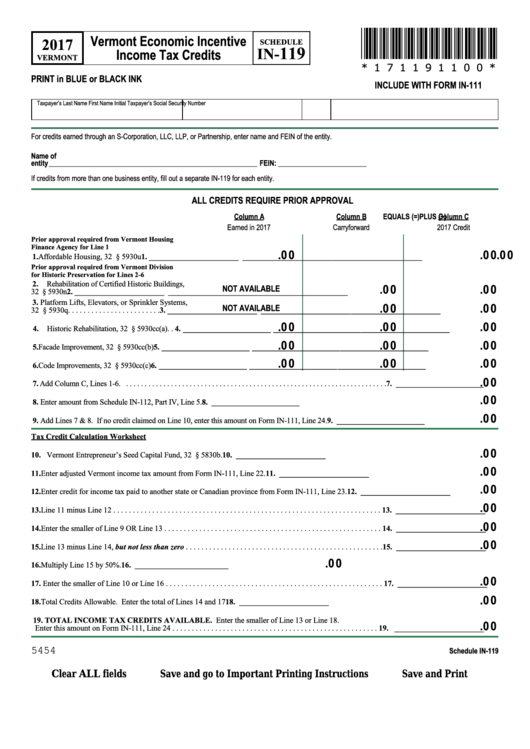

Vermont Economic Incentive

2017

SCHEDULE

119

IN-

Income Tax Credits

VERMONT

* 1 7 1 1 9 1 1 0 0 *

PRINT in BLUE or BLACK INK

INCLUDE WITH FORM IN-111

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

For credits earned through an S-Corporation, LLC, LLP, or Partnership, enter name and FEIN of the entity.

Name of

entity ___________________________________________________________

FEIN: _________________________

If credits from more than one business entity, fill out a separate IN-119 for each entity.

ALL CREDITS REQUIRE PRIOR APPROVAL

Column A

PLUS (+)

Column B

EQUALS (=)

Column C

Earned in 2017

Carryforward

2017 Credit

Prior approval required from Vermont Housing

Finance Agency for Line 1

.0 0

.0 0

.0 0

1.

Affordable Housing, 32 V.S.A. § 5930u . . . . . . 1. _______________________

_______________________

_______________________

Prior approval required from Vermont Division

for Historic Preservation for Lines 2-6

2.

Rehabilitation of Certified Historic Buildings,

.0 0

.0 0

NOT AVAILABLE

32 V.S.A. § 5930n . . . . . . . . . . . . . . . . . . . . . . . . . . 2. _______________________

_______________________

_______________________

3.

Platform Lifts, Elevators, or Sprinkler Systems,

.0 0

.0 0

NOT AVAILABLE

32 V.S.A. § 5930q. . . . . . . . . . . . . . . . . . . . . . . . 3. _______________________

_______________________

_______________________

.0 0

.0 0

.0 0

4.

Historic Rehabilitation, 32 V.S.A. § 5930cc(a) . . 4. _______________________

_______________________

_______________________

.0 0

.0 0

.0 0

5.

Facade Improvement, 32 V.S.A. § 5930cc(b) . . . . 5. _______________________

_______________________

_______________________

.0 0

.0 0

.0 0

6.

Code Improvements, 32 V.S.A. § 5930cc(c) . . . . 6. _______________________

_______________________

_______________________

.0 0

7.

Add Column C, Lines 1-6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

_______________________

.0 0

8.

Enter amount from Schedule IN-112, Part IV, Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

_______________________

.0 0

9.

Add Lines 7 & 8. If no credit claimed on Line 10, enter this amount on Form IN-111, Line 24. . . . . . . . . . . . . . . . 9.

_______________________

Tax Credit Calculation Worksheet

.0 0

10. Vermont Entrepreneur’s Seed Capital Fund, 32 V.S.A. § 5830b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

_______________________

.0 0

11. Enter adjusted Vermont income tax amount from Form IN-111, Line 22. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

_______________________

.0 0

12. Enter credit for income tax paid to another state or Canadian province from Form IN-111, Line 23. . . . . . . . . 12.

_______________________

.0 0

13. Line 11 minus Line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

_______________________

.0 0

14. Enter the smaller of Line 9 OR Line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

_______________________

.0 0

15. Line 13 minus Line 14, but not less than zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

_______________________

.0 0

16. Multiply Line 15 by 50%. . . . . . . . . . . . . . . . . . . . . . . . . . . . .16. ________________________

.0 0

17. Enter the smaller of Line 10 or Line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

_______________________

.0 0

18. Total Credits Allowable. Enter the total of Lines 14 and 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

_______________________

19. TOTAL INCOME TAX CREDITS AVAILABLE. Enter the smaller of Line 13 or Line 18.

.0 0

Enter this amount on Form IN-111, Line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

_______________________

5454

Schedule IN-119

Clear ALL fields

Save and go to Important Printing Instructions

Save and Print

1

1