Instructions For Schedule In-119 - Vermont Economic Incentive Income Tax Credits

ADVERTISEMENT

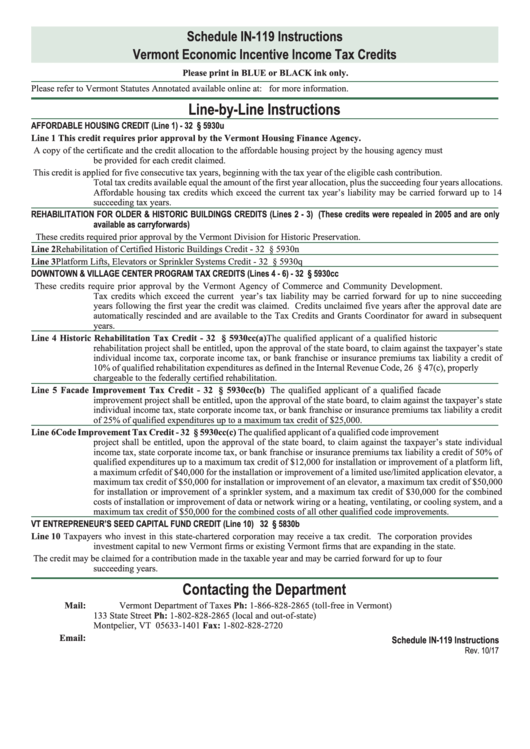

Schedule IN-119 Instructions

Vermont Economic Incentive Income Tax Credits

Please print in BLUE or BLACK ink only.

Please refer to Vermont Statutes Annotated available online at: for more information.

Line-by-Line Instructions

AFFORDABLE HOUSING CREDIT (Line 1) - 32 V.S.A. § 5930u

Line 1

This credit requires prior approval by the Vermont Housing Finance Agency.

A copy of the certificate and the credit allocation to the affordable housing project by the housing agency must

be provided for each credit claimed.

This credit is applied for five consecutive tax years, beginning with the tax year of the eligible cash contribution.

Total tax credits available equal the amount of the first year allocation, plus the succeeding four years allocations.

Affordable housing tax credits which exceed the current tax year’s liability may be carried forward up to 14

succeeding tax years.

REHABILITATION FOR OLDER & HISTORIC BUILDINGS CREDITS (Lines 2 - 3) (These credits were repealed in 2005 and are only

available as carryforwards)

These credits required prior approval by the Vermont Division for Historic Preservation.

Line 2

Rehabilitation of Certified Historic Buildings Credit - 32 V.S.A. § 5930n

Line 3

Platform Lifts, Elevators or Sprinkler Systems Credit - 32 V.S.A. § 5930q

DOWNTOWN & VILLAGE CENTER PROGRAM TAX CREDITS (Lines 4 - 6) - 32 V.S.A. § 5930cc

These credits require prior approval by the Vermont Agency of Commerce and Community Development.

Tax credits which exceed the current year’s tax liability may be carried forward for up to nine succeeding

years following the first year the credit was claimed. Credits unclaimed five years after the approval date are

automatically rescinded and are available to the Tax Credits and Grants Coordinator for award in subsequent

years.

Line 4

Historic Rehabilitation Tax Credit - 32 V.S.A. § 5930cc(a) The qualified applicant of a qualified historic

rehabilitation project shall be entitled, upon the approval of the state board, to claim against the taxpayer’s state

individual income tax, corporate income tax, or bank franchise or insurance premiums tax liability a credit of

10% of qualified rehabilitation expenditures as defined in the Internal Revenue Code, 26 U.S.C. § 47(c), properly

chargeable to the federally certified rehabilitation.

Line 5

Facade Improvement Tax Credit - 32 V.S.A. § 5930cc(b) The qualified applicant of a qualified facade

improvement project shall be entitled, upon the approval of the state board, to claim against the taxpayer’s state

individual income tax, state corporate income tax, or bank franchise or insurance premiums tax liability a credit

of 25% of qualified expenditures up to a maximum tax credit of $25,000.

Line 6

Code Improvement Tax Credit - 32 V.S.A. § 5930cc(c) The qualified applicant of a qualified code improvement

project shall be entitled, upon the approval of the state board, to claim against the taxpayer’s state individual

income tax, state corporate income tax, or bank franchise or insurance premiums tax liability a credit of 50% of

qualified expenditures up to a maximum tax credit of $12,000 for installation or improvement of a platform lift,

a maximum crfedit of $40,000 for the installation or improvement of a limited use/limited application elevator, a

maximum tax credit of $50,000 for installation or improvement of an elevator, a maximum tax credit of $50,000

for installation or improvement of a sprinkler system, and a maximum tax credit of $30,000 for the combined

costs of installation or improvement of data or network wiring or a heating, ventilating, or cooling system, and a

maximum tax credit of $50,000 for the combined costs of all other qualified code improvements.

VT ENTREPRENEUR’S SEED CAPITAL FUND CREDIT (Line 10) 32 V.S.A. § 5830b

Line 10

Taxpayers who invest in this state-chartered corporation may receive a tax credit. The corporation provides

investment capital to new Vermont firms or existing Vermont firms that are expanding in the state.

The credit may be claimed for a contribution made in the taxable year and may be carried forward for up to four

succeeding years.

Contacting the Department

Mail: Vermont Department of Taxes

Ph: 1-866-828-2865 (toll-free in Vermont)

133 State Street

Ph: 1-802-828-2865 (local and out-of-state)

Montpelier, VT 05633-1401

Fax: 1-802-828-2720

Email: tax.individualincome@vermont.gov

Schedule IN-119 Instructions

Rev. 10/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1