Page 1 of 2

S

C

tate of

alifornia

D

r

e

epartment of

eal

State

Providing Service, Protecting You

M

L

D

s

ortgage

oan

iscLosure

tateMent

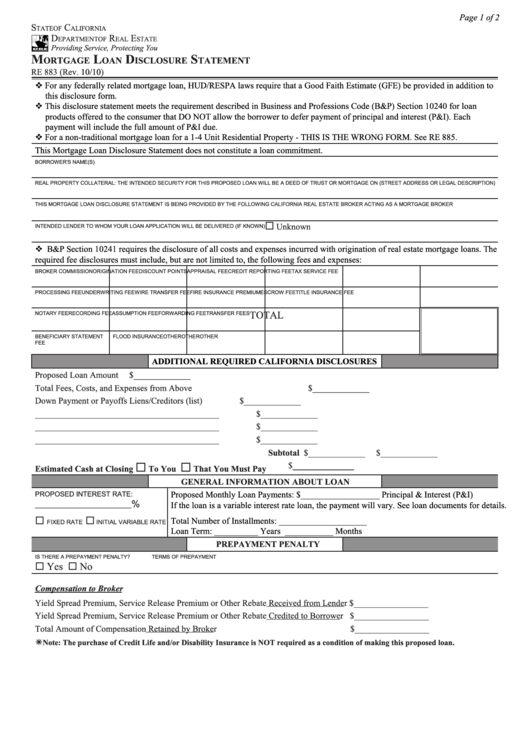

RE 883 (Rev. 10/10)

For any federally related mortgage loan, HUD/RESPA laws require that a Good Faith Estimate (GFE) be provided in addition to

this disclosure form.

This disclosure statement meets the requirement described in Business and Professions Code (B&P) Section 10240 for loan

products offered to the consumer that DO NOT allow the borrower to defer payment of principal and interest (P&I). Each

payment will include the full amount of P&I due.

For a non-traditional mortgage loan for a 1-4 Unit Residential Property - THIS IS THE WRONG FORM. See RE 885.

This Mortgage Loan Disclosure Statement does not constitute a loan commitment.

BORROWER'S NAME(S)

REAL PROPERTY COLLATERAL: THE INTENDED SECURITY FOR THIS PROPOSED LOAN WILL BE A DEED OF TRUST OR MORTGAGE ON (STREET ADDRESS OR LEGAL DESCRIPTION)

THIS MORTGAGE LOAN DISCLOSURE STATEMENT IS BEING PROVIDED BY THE FOLLOWING CALIFORNIA REAL ESTATE BROKER ACTING AS A MORTGAGE BROKER

¨

Unknown

INTENDED LENDER TO WHOM YOUR LOAN APPLICATION WILL BE DELIVERED (IF KNOWN)

B&P Section 10241 requires the disclosure of all costs and expenses incurred with origination of real estate mortgage loans. The

required fee disclosures must include, but are not limited to, the following fees and expenses:

BROKER COMMISSION

ORIGINATION FEE

DISCOUNT POINTS

APPRAISAL FEE

CREDIT REPORTING FEE

TAX SERVICE FEE

PROCESSING FEE

UNDERWRITING FEE

WIRE TRANSFER FEE

FIRE INSURANCE PREMIUM

ESCROW FEE

TITLE INSURANCE FEE

TOTAL

NOTARY FEE

RECORDING FEE

ASSUMPTION FEE

FORWARDING FEE

TRANSFER FEES

BENEFICIARY STATEMENT

FLOOD INSURANCE

OTHER

OTHER

OTHER

FEE

ADDITIONAL REQUIRED CALIFORNIA DISCLOSURES

Proposed Loan Amount

$_____________

Total Fees, Costs, and Expenses from Above

$_____________

Down Payment or Payoffs Liens/Creditors (list)

$_____________

__________________________________________

$_____________

__________________________________________

$_____________

__________________________________________

$_____________

Subtotal $_____________

$_____________

$______________

¨

¨

Estimated Cash at Closing

To You

That You Must Pay

GENERAL INFORMATION ABOUT LOAN

Proposed Monthly Loan Payments: $__________________ Principal & Interest (P&I)

PROPOSED INTEREST RATE:

%

If the loan is a variable interest rate loan, the payment will vary. See loan documents for details.

_________________________________

Total Number of Installments: ____________________

¨

¨

FIXED RATE

INITIAL VARIABLE RATE

Loan Term: __________ Years ___________ Months

PREPAYMENT PENALTY

IS THERE A PREPAYMENT PENALTY?

TERMS OF PREPAYMENT

¨ Yes ¨ No

Compensation to Broker

Yield Spread Premium, Service Release Premium or Other Rebate Received from Lender $_________________

Yield Spread Premium, Service Release Premium or Other Rebate Credited to Borrower $_________________

Total Amount of Compensation Retained by Broker

$_________________

Note: The purchase of Credit Life and/or Disability Insurance is NOT required as a condition of making this proposed loan.

1

1 2

2