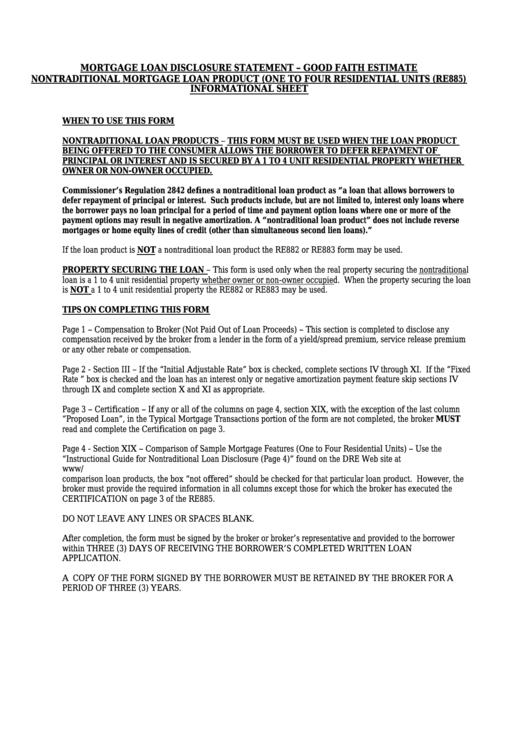

MORTGAGE LOAN DISCLOSURE STATEMENT – GOOD FAITH ESTIMATE

NONTRADITIONAL MORTGAGE LOAN PRODUCT (ONE TO FOUR RESIDENTIAL UNITS (RE885)

INFORMATIONAL SHEET

WHEN TO USE THIS FORM

NONTRADITIONAL LOAN PRODUCTS – THIS FORM MUST BE USED WHEN THE LOAN PRODUCT

BEING OFFERED TO THE CONSUMER ALLOWS THE BORROWER TO DEFER REPAYMENT OF

PRINCIPAL OR INTEREST AND IS SECURED BY A 1 TO 4 UNIT RESIDENTIAL PROPERTY WHETHER

OWNER OR NON-OWNER OCCUPIED.

Commissioner’s Regulation 2842 defines a nontraditional loan product as “a loan that allows borrowers to

defer repayment of principal or interest. Such products include, but are not limited to, interest only loans where

the borrower pays no loan principal for a period of time and payment option loans where one or more of the

payment options may result in negative amortization. A “nontraditional loan product” does not include reverse

mortgages or home equity lines of credit (other than simultaneous second lien loans).”

If the loan product is NOT a nontraditional loan product the RE882 or RE883 form may be used.

PROPERTY SECURING THE LOAN – This form is used only when the real property securing the nontraditional

loan is a 1 to 4 unit residential property whether owner or non-owner occupied. When the property securing the loan

is NOT a 1 to 4 unit residential property the RE882 or RE883 may be used.

TIPS ON COMPLETING THIS FORM

Page 1 – Compensation to Broker (Not Paid Out of Loan Proceeds) – This section is completed to disclose any

compensation received by the broker from a lender in the form of a yield/spread premium, service release premium

or any other rebate or compensation.

Page 2 - Section III – If the “Initial Adjustable Rate” box is checked, complete sections IV through XI. If the “Fixed

Rate ” box is checked and the loan has an interest only or negative amortization payment feature skip sections IV

through IX and complete section X and XI as appropriate.

Page 3 – Certification – If any or all of the columns on page 4, section XIX, with the exception of the last column

“Proposed Loan”, in the Typical Mortgage Transactions portion of the form are not completed, the broker MUST

read and complete the Certification on page 3.

Page 4 - Section XIX – Comparison of Sample Mortgage Features (One to Four Residential Units) – Use the

“Instructional Guide for Nontraditional Loan Disclosure (Page 4)” found on the DRE Web site at

www/dre.ca.gov/frm_forms.html and go to Mortgage Lending Brokers. If the broker does not offer one or more

comparison loan products, the box “not offered” should be checked for that particular loan product. However, the

broker must provide the required information in all columns except those for which the broker has executed the

CERTIFICATION on page 3 of the RE885.

DO NOT LEAVE ANY LINES OR SPACES BLANK.

After completion, the form must be signed by the broker or broker’s representative and provided to the borrower

within THREE (3) DAYS OF RECEIVING THE BORROWER’S COMPLETED WRITTEN LOAN

APPLICATION.

A COPY OF THE FORM SIGNED BY THE BORROWER MUST BE RETAINED BY THE BROKER FOR A

PERIOD OF THREE (3) YEARS.

1

1 2

2 3

3 4

4 5

5 6

6