Page 2

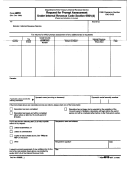

Section III - Payment Information (minimum payment is $250.00 unless you are in compliance with a full payment

installment agreement)

YES

NO

1. Have you made an electronic payment or included a payment of at least $250 (and up to $500) with this request

Amount enclosed

Check number

Electronic payment amount

Payment date

2. Have you entered into an approved installment agreement with the IRS

If you answered “NO” to both questions 1 and 2, then you will NOT receive a reduction of your section 6702

penalty liabilities.

Section IV - Request For Penalty Reduction Relief

Requested Penalty Reduction

Tax form number(s)

Tax year(s)

Section V - Declaration Under Penalties Of Perjury

I understand and agree that if a reduction is granted, I will not be entitled to another reduction if the IRC section 6702 penalty is

assessed again.

If I am under an installment agreement, I understand that if I meet all the requirements and my request for reduction is approved, the

penalty or penalties will be reduced only upon completion of all payments required to satisfy all outstanding tax liabilities other than the

section 6702 penalties that exceed $500 and are the subject of this request. In addition, if prior to completion of these payments, I am

declared in default of an installment agreement, the penalty will not be reduced.

I understand that any request for reduction of my section 6702 penalty liabilities will be rejected if it does not meet all of the conditions

of Revenue Procedure 2012-43, asserts positions identified as frivolous under section 6702(c), or is determined to have been made

with an intention to delay or impede tax administration. I understand that I will be notified of the rejection and that I cannot appeal the

rejection of my request to the IRS Office of Appeals for any reason. If my reduction request is rejected, I understand that any payment

submitted with this request will be applied against any outstanding section 6702 penalty liability due.

Under penalties of perjury, I declare that I have filed all returns (including any accompanying schedules and statements) and paid or

entered into a full payment installment agreement to pay all taxes and liabilities as described in Revenue Procedure 2012-43. To the

best of my knowledge and belief, the information on this form is true, correct, and complete.

Signature

Date signed

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue Laws of the United States. Section 6702(d) and Revenue Procedure 2012-43

describe the conditions under which you may request a reduction of assessed section 6702 penalty liabilities. Section 6109 requires that you provide

your taxpayer identification number (TIN). You may use Form 14402 to request a section 6702 penalty reduction. You are required to provide the

information requested on this form only if you wish to have your unpaid section 6702 penalty liabilities reduced. We need this information to ensure that

you have met the requirements of section 6702(d) and Revenue Procedure 2012-43. If you do not provide this information, your request will be denied.

You may be subject to civil and criminal penalties if you provide false or fraudulent information.

We may disclose this information to the Department of Justice for civil or criminal litigation, and to cities, states, and the District of Columbia for use in

administering their tax laws. We may also disclose this information to other countries under a tax treaty, to Federal and state agencies to enforce

Federal nontax criminal laws, or to Federal law enforcement and intelligence agencies to combat terrorism. Generally, tax returns and tax return

information are confidential, as required by section 6103.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB

control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the

administration of any Internal Revenue law.

The time needed to complete this form will vary depending on particular circumstances. The estimated average time is:

Recordkeeping……………………………………………

Learning about the law of the form………………………

Preparing the form……………………………………….

Copying, assembling, and sending the form to the IRS….

14402

Catalog Number 59694G

Form

(11-2012)

1

1 2

2 3

3 4

4