BOE-531 (BACK) REV. 6 (1-07)

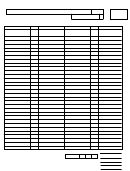

SCHEDULE B

DETAILED ALLOCATION BY COUNTY OF COMBINED STATE

AND UNIFORM LOCAL SALES AND USE TAX

If your business activities come within one or more of the categories listed below, part or all of your state and local sales and use tax

should be allocated among the counties listed on Schedule B, Detailed Allocation by County of Uniform Local Sales and Use Tax.

Enter in Column C, after the name of the appropriate county, the amount of local tax allocable to the county according to the

instructions below that are applicable to your business.

1. AUCTIONEERS (Ref. Regulations 1802 and 1803)

For auction events at temporary sales locations where taxable gross sales are $500,000 or more, the combined state and local sales

tax should be reported on the BOE-530-B, Combined State and Local Tax Allocation for Temporary Sales Locations and Certain

Auctioneers. For all other auction events at temporary sales locations, the amount of combined state and local sales tax on sales

made away from your permanent place of business should be entered in Column C of this form, opposite the name of each county

in which auctions were held. Enter on line B2 any amount of combined state and local tax that is applicable to auction sales,

over-the-counter sales or other transactions at your permanent place of business.

2. OUT-OF-STATE RETAILERS WHO HAVE BEEN AUTHORIZED BY THIS BOARD TO OPERATE UNDER

SECTION 6015 (Regulation 1802)

Enter in Column C the amount of combined state and local tax on sales made by representatives who operate from locations in

each county.

3. VENDING MACHINE OPERATORS (Regulations 1574 and 1802)

Enter in Column C, the amount of combined state and local tax on sales made from vending machines located in each county. Enter

on line B2 any amount of combined state and local tax which is applicable to sales of equipment or other transactions at your

permanent place of business.

4. OUT-OF-STATE SELLERS ENGAGED IN BUSINESS IN CALIFORNIA (Regulations 1802 and 1803)

Sales of goods negotiated out of state and delivered from a stock of goods in state should be entered on Line B2 of this form.

Sales negotiated out of state by sellers (who are engaged in business in California) that are delivered from locations out of state with

title passing to a California purchaser at a point outside of California are subject to combined state and local use tax and should be

entered in Column C opposite the county of destination.

For transactions of $500,000 or more by sellers engaged in business in California, the combined state and local use tax should be

reported on Schedule F, Detailed Allocations of 1% Combined State and Uniform Local Sales and Use Tax.

OUT-OF-STATE SELLERS NOT ENGAGED IN BUSINESS IN CALIFORNIA (Regulations 1802 and 1803)

Sellers not engaged in business in California, but who voluntarily collect and report use tax may report transactions of $500,000

or more on Schedule F, Detailed Allocation of 1% Combined State and Uniform Local Sales and Use Tax, in accordance with the

above, or continue to report on Schedule B.

CONSTRUCTION CONTRACTORS (Regulation 1806)

5.

A contractor must report the combined state and local tax with respect to materials and fixtures involved in construction contracts

according to the county location of the jobsite where use occurred. Enter this tax in Column C opposite the appropriate county.

Enter on line B2 any amount of combined state and local tax applicable to retail store sales or regular retail sales at your permanent

place of business which do not involve a construction contract.

6. PERSONS MAKING EX-TAX PURCHASES FOR USE AT LOCATIONS WHERE A SELLER�S

PERMIT IS NOT REQUIRED (Regulation 1803)

A person who purchases tangible personal property without payment of combined state and uniform local tax is liable for combined

state and local use tax on such purchases. If the property is used at a location for which a seller�s permit is not required, and is a

purchase of less than $500,000, enter the amount in Column C of this form opposite the county where the property is used. If

property is used at a location for which a seller�s permit is not required and is a purchase of $500,000 or more, local tax should be

reported on Schedule F, Detailed Allocation of 1% Combined State and Uniform Local Sales and Use Tax.

Line B2. COMBINED STATE AND LOCAL TAX AT PERMANENT PLACE OF BUSINESS. Enter here the amount of combined state

and local tax on sales made and merchandise consumed at your permanent place of business in California. Do not include any

combined state and local use tax reported by counties in Column C. In addition, enter the 1% combined state and local tax from

sales of goods negotiated out of state and delivered from an in-state stock of goods.

NOTE: If you are furnished with Schedule C, Detailed Allocation by Suboutlet of Combined State and Uniform Local Sales and Use

Tax, the amount entered on line B2 must agree with the total amount of Combined State and Local Tax shown on Schedule C.

7. MOTOR VEHICLE LEASES

If you are a lessor of motor vehicles who is not required to use Schedule F, you should report the 1% combined state and local tax

on Schedule B (the tax should be reported in the county where the vehicle is registered).

8. BAD DEBT LENDERS

If you are claiming a deduction for Bad Debt-Lender, you are required to complete Schedule L. In most cases, the Schedule L total

needs to be entered on line "B4" as a negative number. However, if bad debt-lender recoveries exceed losses, the Schedule L total

would be a positive amount.

CLEAR

PRINT

1

1 2

2