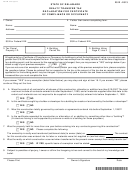

INSTRUCTIONS FOR COMPLETING REALTY TRANSFER TAX STATEMENT OF VALUE

2. Check Appropriate Box for Exemption Claimed -

SECTION A

Boxes are provided for the most common Pennsylvania

Correspondent: Enter the name, address and telephone

realty exemptions. Each is explained in order of appear-

number of party completing this form.

ance on the Realty Transfer Statement of Value form.

Will or Intestate Succession – A transfer by will for no

SECTION B

or nominal consideration, or under the intestate succession

Transfer Data: Enter the date on which the deed or other

laws, is exempt from tax. Provide the name of the decedent

and estate file number in the space provided.

document was accepted by the Party(ies). Enter the full

names and addresses of all Grantor(s)/Lessor(s) and all

Transfer to a Trust – A transfer for no or nominal consid-

Grantee(s)/Lessee(s). Attach additional sheets if necessary.

eration to a trust is exempt from tax when the transfer of

the same property would be exempt from tax if the trans-

SECTION C

fer were made directly by the grantor to all the possible

(including contingent) beneficiaries. Attach a complete

Real Estate Location: This section identifies the real

copy of the trust agreement and identify the grantor’s rela-

estate to be transferred. Complete fully, including the tax

tionship to each beneficiary.

parcel number where applicable and the county where the

statement is to be filed.

Transfer Between Principal and Agent/Straw Party –

A transfer between an agent/straw party and principal for

SECTION D

no or nominal consideration is exempt. Attach a complete

copy of the agency/straw party agreement.

Valuation Data: Complete for all transactions

Transfer to the Commonwealth, the United States

1. Actual Cash Consideration – Enter the amount of

and Instrumentalities by Gift, Dedication, Condemna-

cash or cash equivalent that the grantor received for

tion or in Lieu of Condemnation. – If the transfer is by

the transfer of the real estate.

condemnation or in lieu of condemnation, attach a copy of

the resolution.

2. Other Consideration – Enter the total amount of non-

cash consideration that the grantor received for the

Transfer from Mortgagor to Holder of a Mortgage in

transfer of the real estate, such as property and secu-

Default – A transfer from a mortgagor to a holder of a

rities. Include mortgages and liens existing before the

mortgage in default, whether pursuant to a foreclosure or

transfer and not removed thereby, and the agreed con-

in lieu thereof, is exempt. Provide a copy of the mortgage

sideration for the construction of improvements.

and note, and any documentation evidencing the assign-

ment thereof.

3. Total Consideration – Enter the sum of Lines 1 and 2.

This will be the total consideration for the purchase of

Corrective Deed – A deed for no or nominal consideration

the real estate.

that corrects or confirms a previously recorded deed but

does not extend or limit the title or interest under the prior

4. County Assessed Value - Enter the actual assessed

deed is exempt from tax. Attach a complete copy of the

value of the entire real estate, per records of the county

prior deed being corrected or confirmed.

assessment office. Do not reduce the assessed value by

the grantor’s fractional interest in the real estate.

Statutory Consolidation, Merger or Division – A docu-

ment that evidences the transfer of real estate pursuant to

5. Common Level Ratio Factor – Enter the common

the statutory consolidation or merger of two or more cor-

level ratio factor for the county in which the real estate is

porations (15 Pa. C.S. §1921-1932 or 15 Pa. C.S. §5921-

located. An explanation of this factor is provided below.

5930) or the statutory division of a nonprofit corporation

6. Fair Market Value – Enter the product of Lines 4 and 5.

(15 Pa. C.S. §5951-5957) is exempt from tax. Attach a

copy of the articles of consolidation, merger or division.

SECTION E

Other –

Exemption Data: Complete only for transactions claiming

When claiming an exemption other than those listed, you

an exemption.

must specify what exemption is claimed. When possible,

provide the applicable statutory and regulatory citation.

1a. Amount of Exemption Claimed – Enter the dollar

Attach additional pages, if necessary. Attach a copy of

amount of the total consideration claimed as exempt.

supporting documentation.

1b. Percentage of Grantor’s Interest in Real Estate –

COMMON LEVEL RATIO FACTOR

Enter the percentage of grantor’s ownership interest in

This is a property valuation factor provided by the PA

the real estate listed in Part C.

Department of Revenue by which the county assessed

1c. Percentage of Grantor’s Interest Conveyed – Enter

value is multiplied to determine the taxable value of real

the fraction or percentage of grantor’s interest in the

estate for all non-arm’s length transactions, leases and

real estate listed on Line 1b that the grantor conveyed

acquired companies. The factor is based on the common

to the grantee. For example, if you indicated on Line 1b

level ratio established by the State Tax Equalization Board.

that grantor owns a 50 percent tenant in common

The common level ratio is a ratio of assessed values to cur-

interest in the real estate and grantor is conveying his

rent fair market values as reflected by actual sales of real

entire 50 percent interest to the grantee, then you

estate in each county. A statewide list of the factors is avail-

would enter 100 percent on this line.

able at the Recorder of Deeds’ office in each county.

THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION.

1

1 2

2