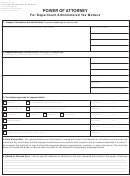

6. Retention/Revocation of Prior Power(s) of Attorney — The filing of this power of attorney automatically revokes all earlier power(s)

of attorney on file with the Colorado Department of Revenue for the same tax matters and periods covered by this document. If you do

not want to revoke a prior power of attorney, check here ..........................................................................................................................................

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7. Signature of Taxpayer(s) — If this form is not signed, dated and titled (if applicable), it is invalid. If tax matters concern a joint return, both parties must

sign for joint representation. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, estate administrator or trustee

on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

Signature

Date

Print Name

Title

Signature

Date

Print Name

Title

8. Declaration of Representative —I am authorized to represent the taxpayer(s) identified in number 1 for the tax matter(s) specified.

Signature

Date

Title

I represent the taxpayer(s) identified in number 1 as:

CO-licensed attorney, Reg Number

Attorney registered in _____________________

CO-licensed CPA

CPA licensed in _________________________

Full-time employee of the taxpayer

Enrolled agent __________________________

Other, explain _________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

Signature

Date

Title

I represent the taxpayer(s) identified in number 1 as:

CO-licensed attorney, Reg Number

Attorney registered in _____________________

CO-licensed CPA

CPA licensed in _________________________

Full-time employee of the taxpayer

Enrolled agent __________________________

Other, explain _________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

Processing will be faster if addressed to a specific section of the Department, and if you can, attach copies of documentation of the issue in dispute, such

as a Refund Claim, Notice of Deficiency, Notice of Refund Denial, Federal Revenue Agents Report, etc. Where the address does not specify a section,

this form will be directed to Taxpayer Service, 1375 Sherman St., Denver, CO 80261.

1

1 2

2