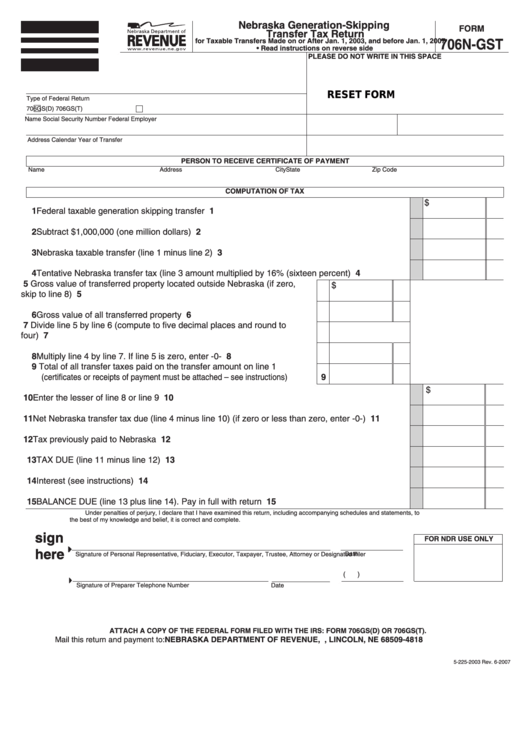

Nebraska Generation-Skipping

FORM

Transfer Tax Return

706N-GST

for Taxable Transfers Made on or After Jan. 1, 2003, and before Jan. 1, 2007

• Read instructions on reverse side

PLEASE DO NOT WRITE IN THIS SPACE

RESET FORM

Type of Federal Return

706GS(D)

706GS(T)

Name

Social Security Number

Federal Employer I.D. Number

Address

Calendar Year of Transfer

PERSON TO RECEIVE CERTIFICATE OF PAYMENT

Name

Address

City

State

Zip Code

COMPUTATION OF TAX

$

1 Federal taxable generation skipping transfer .................................................................................. 1

2 Subtract $1,000,000 (one million dollars) ....................................................................................... 2

3 Nebraska taxable transfer (line 1 minus line 2)............................................................................... 3

4 Tentative Nebraska transfer tax (line 3 amount multiplied by 16% (sixteen percent)...................... 4

5 Gross value of transferred property located outside Nebraska (if zero,

$

5

skip to line 8)...........................................................................................

6 Gross value of all transferred property....................................................

6

7 Divide line 5 by line 6 (compute to five decimal places and round to

7

four).........................................................................................................

8 Multiply line 4 by line 7. If line 5 is zero, enter -0- ...................................

8

9 Total of all transfer taxes paid on the transfer amount on line 1

(certificates or receipts of payment must be attached – see instructions) ........... 9

$

10 Enter the lesser of line 8 or line 9 ................................................................................................... 10

11 Net Nebraska transfer tax due (line 4 minus line 10) (if zero or less than zero, enter -0-).............. 11

12 Tax previously paid to Nebraska ..................................................................................................... 12

13 TAX DUE (line 11 minus line 12)..................................................................................................... 13

14 Interest (see instructions) ............................................................................................................... 14

15 BALANCE DUE (line 13 plus line 14). Pay in full with return .......................................................... 15

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, to

the best of my knowledge and belief, it is correct and complete.

sign

sign

FOR NDR USE ONLY

here

here

Date

Signature of Personal Representative, Fiduciary, Executor, Taxpayer, Trustee, Attorney or Designated Filer

(

)

Signature of Preparer

Date

Telephone Number

ATTACH A COPY OF THE FEDERAL FORM FILED WITH THE IRS: FORM 706GS(D) OR 706GS(T).

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

5-225-2003 Rev. 6-2007

1

1 2

2