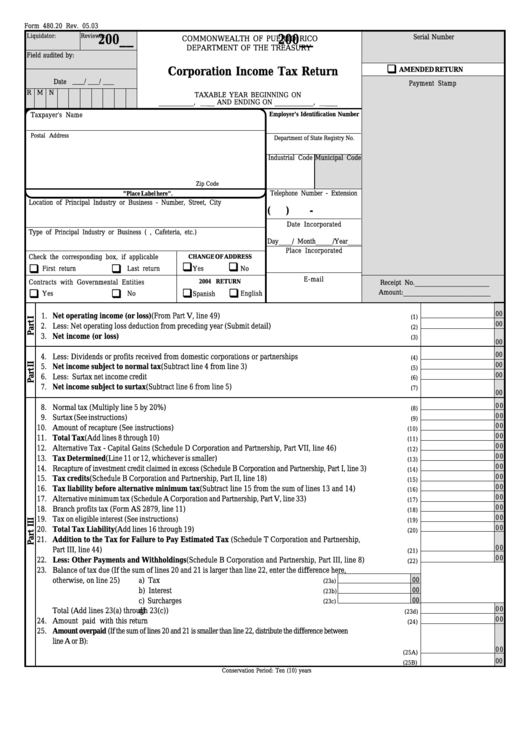

Form 480.20 - Corporation Income Tax Return

ADVERTISEMENT

Form 480.20 Rev. 05.03

Liquidator:

Reviewer:

200__

200__

Serial Number

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field audited by:

q

Corporation Income Tax Return

AMENDED RETURN

Date

Payment Stamp

R

N

M

TAXABLE YEAR BEGINNING ON

_________

__

__________

___

, __

AND ENDING ON

, __

Employer's Identification Number

Taxpayer's Name

Postal Address

Department of State Registry No.

Industrial Code

Municipal Code

Zip Code

Telephone Number - Extension

"Place Label here".

Location of Principal Industry or Business - Number, Street, City

(

)

-

Date Incorporated

Type of Principal Industry or Business (i.e. Hardware, Cafeteria, etc.)

Day____/ Month_____/Year____

Place Incorporated

Check the corresponding box, if applicable

CHANGE OF ADDRESS

q

q

q

q

First return

Last return

Yes

No

E-mail

Contracts with Governmental Entities

2004 RETURN

___________________

Receipt No.

q

q

q

q

______________________

Amount:

Yes

No

Spanish

English

00

1.

Net operating income (or loss) (From Part V, line 49) ................................................................................................

(1)

00

2.

Less: Net operating loss deduction from preceding year (Submit detail) .......................................................................

(2)

3.

Net income (or loss) .....................................................................................................................................................

(3)

00

00

4.

Less: Dividends or profits received from domestic corporations or partnerships .........................................................

(4)

00

5.

Net income subject to normal tax (Subtract line 4 from line 3) ..................................................................................

(5)

00

6.

Less: Surtax net income credit .......................................................................................................................................

(6)

7.

Net income subject to surtax (Subtract line 6 from line 5) ..........................................................................................

(7)

00

0 0

8.

Normal tax (Multiply line 5 by 20%) .............................................................................................................................

(8)

0 0

9.

Surtax (See instructions)..................................................................................................................................................

(9)

0 0

10.

Amount of recapture (See instructions)..........................................................................................................................

(10)

0 0

11.

Total Tax (Add lines 8 through 10) ................................................................................................................................

(11)

0 0

12.

Alternative Tax - Capital Gains (Schedule D Corporation and Partnership, Part VII, line 46) .....................................

(12)

0 0

13.

Tax Determined (Line 11 or 12, whichever is smaller) ..................................................................................................

(13)

0 0

14.

Recapture of investment credit claimed in excess (Schedule B Corporation and Partnership, Part I, line 3)

(14)

0 0

15.

Tax credits (Schedule B Corporation and Partnership, Part II, line 18) ........................................................................

(15)

0 0

16.

Tax liability before alternative minimum tax (Subtract line 15 from the sum of lines 13 and 14)...........................

(16)

0 0

17.

Alternative minimum tax (Schedule A Corporation and Partnership, Part V, line 33) .....................................................

(17)

0 0

18.

Branch profits tax (Form AS 2879, line 11) ...................................................................................................................

(18)

0 0

19.

Tax on eligible interest (See instructions) .......................................................................................................................

(19)

0 0

20.

Total Tax Liability (Add lines 16 through 19) ..............................................................................................................

(20)

21.

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Corporation and Partnership,

0 0

Part III, line 44) ..............................................................................................................................................................

(21)

0 0

22.

Less: Other Payments and Withholdings (Schedule B Corporation and Partnership, Part III, line 8) .....................

(22)

23.

Balance of tax due (If the sum of lines 20 and 21 is larger than line 22, enter the difference here,

otherwise, on line 25)

a) Tax ...................................................................................

00

(23a)

b) Interest .............................................................................

00

(23b)

c) Surcharges .........................................................................

00

(23c)

0 0

d)

Total (Add lines 23(a) through 23(c)) .....................................................................

(23d)

0 0

24.

Amount paid with this return ....................................................................................................................................

(24)

25.

Amount overpaid (If the sum of lines 20 and 21 is smaller than line 22, distribute the difference between

line A or B):

0 0

A. To be credited to estimated tax for 2004 ....................................................................................................

(25A)

00

B. To be refunded ............................................................................................................................................

(25B)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4