Instructions For Forms Ct-12-717a And Ct-12-717b - Change Of Resident Status - Special Accruals

ADVERTISEMENT

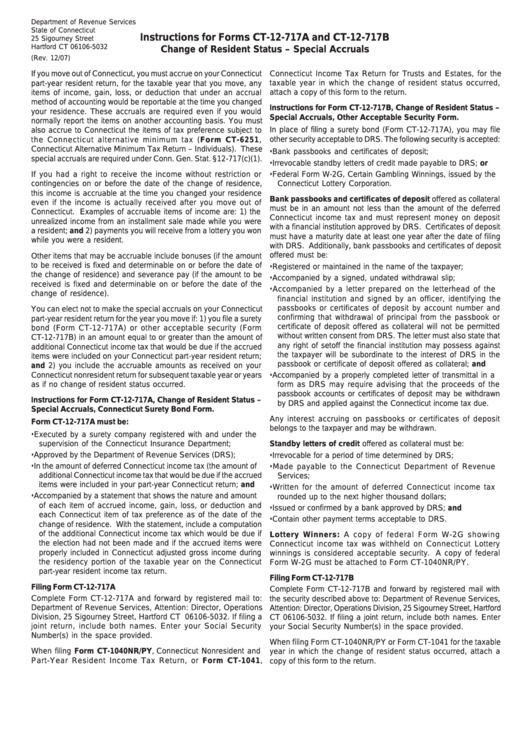

Department of Revenue Services

State of Connecticut

Instructions for Forms CT-12-717A and CT-12-717B

25 Sigourney Street

Hartford CT 06106-5032

Change of Resident Status – Special Accruals

(Rev. 12/07)

If you move out of Connecticut, you must accrue on your Connecticut

Connecticut Income Tax Return for Trusts and Estates, for the

part-year resident return, for the taxable year that you move, any

taxable year in which the change of resident status occurred,

attach a copy of this form to the return.

items of income, gain, loss, or deduction that under an accrual

method of accounting would be reportable at the time you changed

Instructions for Form CT-12-717B, Change of Resident Status –

your residence. These accruals are required even if you would

Special Accruals, Other Acceptable Security Form.

normally report the items on another accounting basis. You must

In place of filing a surety bond (Form CT-12-717A), you may file

also accrue to Connecticut the items of tax preference subject to

other security acceptable to DRS. The following security is accepted:

the Connecticut alternative minimum tax (Form CT-6251,

Connecticut Alternative Minimum Tax Return – Individuals). These

• Bank passbooks and certificates of deposit;

special accruals are required under Conn. Gen. Stat. §12-717(c)(1).

• Irrevocable standby letters of credit made payable to DRS; or

If you had a right to receive the income without restriction or

• Federal Form W-2G, Certain Gambling Winnings, issued by the

Connecticut Lottery Corporation.

contingencies on or before the date of the change of residence,

this income is accruable at the time you changed your residence

Bank passbooks and certificates of deposit offered as collateral

even if the income is actually received after you move out of

must be in an amount not less than the amount of the deferred

Connecticut. Examples of accruable items of income are: 1) the

Connecticut income tax and must represent money on deposit

unrealized income from an installment sale made while you were

with a financial institution approved by DRS. Certificates of deposit

a resident; and 2) payments you will receive from a lottery you won

must have a maturity date at least one year after the date of filing

while you were a resident.

with DRS. Additionally, bank passbooks and certificates of deposit

offered must be:

Other items that may be accruable include bonuses (if the amount

to be received is fixed and determinable on or before the date of

• Registered or maintained in the name of the taxpayer;

the change of residence) and severance pay (if the amount to be

• Accompanied by a signed, undated withdrawal slip;

received is fixed and determinable on or before the date of the

• Accompanied by a letter prepared on the letterhead of the

change of residence).

financial institution and signed by an officer, identifying the

passbooks or certificates of deposit by account number and

You can elect not to make the special accruals on your Connecticut

confirming that withdrawal of principal from the passbook or

part-year resident return for the year you move if: 1) you file a surety

certificate of deposit offered as collateral will not be permitted

bond (Form CT-12-717A) or other acceptable security (Form

without written consent from DRS. The letter must also state that

CT-12-717B) in an amount equal to or greater than the amount of

any right of setoff the financial institution may possess against

additional Connecticut income tax that would be due if the accrued

the taxpayer will be subordinate to the interest of DRS in the

items were included on your Connecticut part-year resident return;

passbook or certificate of deposit offered as collateral; and

and 2) you include the accruable amounts as received on your

Connecticut nonresident return for subsequent taxable year or years

• Accompanied by a properly completed letter of transmittal in a

as if no change of resident status occurred.

form as DRS may require advising that the proceeds of the

passbook accounts or certificates of deposit may be withdrawn

Instructions for Form CT-12-717A, Change of Resident Status –

by DRS and applied against the Connecticut income tax due.

Special Accruals, Connecticut Surety Bond Form.

Any interest accruing on passbooks or certificates of deposit

Form CT-12-717A must be:

belongs to the taxpayer and may be withdrawn.

• Executed by a surety company registered with and under the

supervision of the Connecticut Insurance Department;

Standby letters of credit offered as collateral must be:

• Approved by the Department of Revenue Services (DRS);

• Irrevocable for a period of time determined by DRS;

• In the amount of deferred Connecticut income tax (the amount of

• Made payable to the Connecticut Department of Revenue

additional Connecticut income tax that would be due if the accrued

Services;

items were included in your part-year Connecticut return; and

• Written for the amount of deferred Connecticut income tax

• Accompanied by a statement that shows the nature and amount

rounded up to the next higher thousand dollars;

of each item of accrued income, gain, loss, or deduction and

• Issued or confirmed by a bank approved by DRS; and

each Connecticut item of tax preference as of the date of the

• Contain other payment terms acceptable to DRS.

change of residence. With the statement, include a computation

of the additional Connecticut income tax which would be due if

Lottery Winners: A copy of federal Form W-2G showing

the election had not been made and if the accrued items were

Connecticut income tax was withheld on Connecticut Lottery

properly included in Connecticut adjusted gross income during

winnings is considered acceptable security. A copy of federal

the residency portion of the taxable year on the Connecticut

Form W-2G must be attached to Form CT-1040NR/PY.

part-year resident income tax return.

Filing Form CT-12-717B

Filing Form CT-12-717A

Complete Form CT-12-717B and forward by registered mail with

Complete Form CT-12-717A and forward by registered mail to:

the security described above to: Department of Revenue Services,

Department of Revenue Services, Attention: Director, Operations

Attention: Director, Operations Division, 25 Sigourney Street, Hartford

Division, 25 Sigourney Street, Hartford CT 06106-5032. If filing a

CT 06106-5032. If filing a joint return, include both names. Enter

joint return, include both names. Enter your Social Security

your Social Security Number(s) in the space provided.

Number(s) in the space provided.

When filing Form CT-1040NR/PY or Form CT-1041 for the taxable

When filing Form CT-1040NR/PY, Connecticut Nonresident and

year in which the change of resident status occurred, attach a

Part-Year Resident Income Tax Return, or Form CT-1041,

copy of this form to the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1