Instructions For City Of Massillon Income Tax Return

ADVERTISEMENT

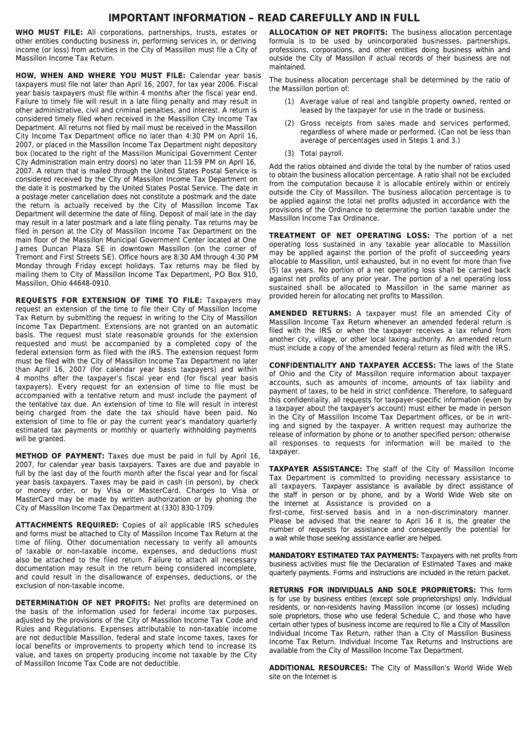

IMPORTANT INFORMATION – READ CAREFULLY AND IN FULL

WHO MUST FILE: All corporations, partnerships, trusts, estates or

ALLOCATION OF NET PROFITS: The business allocation percentage

other entities conducting business in, performing services in, or deriving

formula is to be used by unincorporated businesses, partnerships,

income (or loss) from activities in the City of Massillon must file a City of

professions, corporations, and other entities doing business within and

Massillon Income Tax Return.

outside the City of Massillon if actual records of their business are not

maintained.

HOW, WHEN AND WHERE YOU MUST FILE: Calendar year basis

The business allocation percentage shall be determined by the ratio of

taxpayers must file not later than April 16, 2007, for tax year 2006. Fiscal

the Massillon portion of:

year basis taxpayers must file within 4 months after the fiscal year end.

Failure to timely file will result in a late filing penalty and may result in

(1) Average value of real and tangible property owned, rented or

other administrative, civil and criminal penalties, and interest. A return is

leased by the taxpayer for use in the trade or business.

considered timely filed when received in the Massillon City Income Tax

(2) Gross receipts from sales made and services performed,

Department. All returns not filed by mail must be received in the Massillon

regardless of where made or performed. (Can not be less than

City Income Tax Department office no later than 4:30 PM on April 16,

average of percentages used in Steps 1 and 3.)

2007, or placed in the Massillon Income Tax Department night depository

box (located to the right of the Massillon Municipal Government Center

(3) Total payroll.

City Administration main entry doors) no later than 11:59 PM on April 16,

Add the ratios obtained and divide the total by the number of ratios used

2007. A return that is mailed through the United States Postal Service is

to obtain the business allocation percentage. A ratio shall not be excluded

considered received by the City of Massillon Income Tax Department on

from the computation because it is allocable entirely within or entirely

the date it is postmarked by the United States Postal Service. The date in

outside the City of Massillon. The business allocation percentage is to

a postage meter cancellation does not constitute a postmark and the date

be applied against the total net profits adjusted in accordance with the

the return is actually received by the City of Massillon Income Tax

provisions of the Ordinance to determine the portion taxable under the

Department will determine the date of filing. Deposit of mail late in the day

Massillon Income Tax Ordinance.

may result in a later postmark and a late filing penalty. Tax returns may be

filed in person at the City of Massillon Income Tax Department on the

TREATMENT OF NET OPERATING LOSS: The portion of a net

main floor of the Massillon Municipal Government Center located at One

operating loss sustained in any taxable year allocable to Massillon

James Duncan Plaza SE in downtown Massillon (on the corner of

may be applied against the portion of the profit of succeeding years

Tremont and First Streets SE). Office hours are 8:30 AM through 4:30 PM

allocable to Massillon, until exhausted, but in no event for more than five

Monday through Friday except holidays. Tax returns may be filed by

(5) tax years. No portion of a net operating loss shall be carried back

mailing them to City of Massillon Income Tax Department, PO Box 910,

against net profits of any prior year. The portion of a net operating loss

Massillon, Ohio 44648-0910.

sustained shall be allocated to Massillon in the same manner as

provided herein for allocating net profits to Massillon.

REQUESTS FOR EXTENSION OF TIME TO FILE: Taxpayers may

request an extension of the time to file their City of Massillon Income

AMENDED RETURNS: A taxpayer must file an amended City of

Tax Return by submitting the request in writing to the City of Massillon

Massillon Income Tax Return whenever an amended federal return is

Income Tax Department. Extensions are not granted on an automatic

filed with the IRS or when the taxpayer receives a tax refund from

basis. The request must state reasonable grounds for the extension

another city, village, or other local taxing authority. An amended return

requested and must be accompanied by a completed copy of the

must include a copy of the amended federal return as filed with the IRS.

federal extension form as filed with the IRS. The extension request form

must be filed with the City of Massillon Income Tax Department no later

CONFIDENTIALITY AND TAXPAYER ACCESS: The laws of the State

than April 16, 2007 (for calendar year basis taxpayers) and within

of Ohio and the City of Massillon require information about taxpayer

4 months after the taxpayer’s fiscal year end (for fiscal year basis

accounts, such as amounts of income, amounts of tax liability and

taxpayers). Every request for an extension of time to file must be

payment of taxes, to be held in strict confidence. Therefore, to safeguard

accompanied with a tentative return and must include the payment of

this confidentiality, all requests for taxpayer-specific information (even by

the tentative tax due. An extension of time to file will result in interest

a taxpayer about the taxpayer’s account) must either be made in person

being charged from the date the tax should have been paid. No

in the City of Massillon Income Tax Department offices, or be in writ-

extension of time to file or pay the current year’s mandatory quarterly

ing and signed by the taxpayer. A written request may authorize the

estimated tax payments or monthly or quarterly withholding payments

release of information by phone or to another specified person; otherwise

will be granted.

all responses to requests for information will be mailed to the

taxpayer.

METHOD OF PAYMENT: Taxes due must be paid in full by April 16,

2007, for calendar year basis taxpayers. Taxes are due and payable in

TAXPAYER ASSISTANCE: The staff of the City of Massillon Income

full by the last day of the fourth month after the fiscal year and for fiscal

Tax Department is committed to providing necessary assistance to

year basis taxpayers. Taxes may be paid in cash (in person), by check

all taxpayers. Taxpayer assistance is available by direct assistance of

or money order, or by Visa or MasterCard. Charges to Visa or

the staff in person or by phone, and by a World Wide Web site on

MasterCard may be made by written authorization or by phoning the

the Internet at Assistance is provided on a

City of Massillon Income Tax Department at (330) 830-1709.

first-come, first-served basis and in a non-discriminatory manner.

Please be advised that the nearer to April 16 it is, the greater the

ATTACHMENTS REQUIRED: Copies of all applicable IRS schedules

number of requests for assistance and consequently the potential for

and forms must be attached to City of Massillon Income Tax Return at the

a wait while those seeking assistance earlier are helped.

time of filing. Other documentation necessary to verify all amounts

of taxable or non-taxable income, expenses, and deductions must

MANDATORY ESTIMATED TAX PAYMENTS: Taxpayers with net profits from

also be attached to the filed return. Failure to attach all necessary

business activities must file the Declaration of Estimated Taxes and make

documentation may result in the return being considered incomplete,

quarterly payments. Forms and instructions are included in the return packet.

and could result in the disallowance of expenses, deductions, or the

exclusion of non-taxable income.

RETURNS FOR INDIVIDUALS AND SOLE PROPRIETORS: This form

is for use by business entities (except sole proprietorships) only. Individual

DETERMINATION OF NET PROFITS: Net profits are determined on

residents, or non-residents having Massillon income (or losses) including

the basis of the information used for federal income tax purposes,

sole proprietors, those who use federal Schedule C, and those who have

adjusted by the provisions of the City of Massillon Income Tax Code and

certain other types of business income are required to file a City of Massillon

Rules and Regulations. Expenses attributable to non-taxable income

Individual Income Tax Return, rather than a City of Massillon Business

are not deductible Massillon, federal and state income taxes, taxes for

Income Tax Return. Individual Income Tax Returns and Instructions are

local benefits or improvements to property which tend to increase its

available from the City of Massillon Income Tax Department.

value, and taxes on property producing income not taxable by the City

of Massillon Income Tax Code are not deductible.

ADDITIONAL RESOURCES: The City of Massillon’s World Wide Web

site on the Internet is

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1