Form Ri-6238 - Residential Lead Abatement Credit - 2004

ADVERTISEMENT

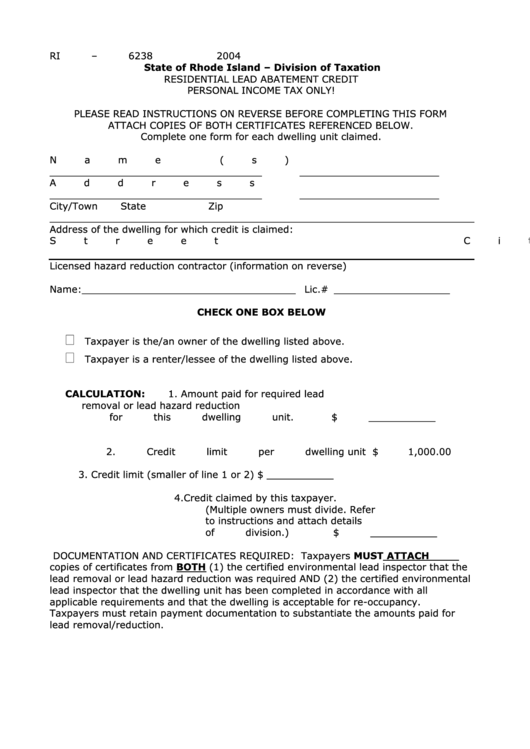

RI – 6238

2004

State of Rhode Island – Division of Taxation

RESIDENTIAL LEAD ABATEMENT CREDIT

PERSONAL INCOME TAX ONLY!

PLEASE READ INSTRUCTIONS ON REVERSE BEFORE COMPLETING THIS FORM

ATTACH COPIES OF BOTH CERTIFICATES REFERENCED BELOW.

Complete one form for each dwelling unit claimed.

Name (s)

Social Security #

___________________________________

_______________________

Address

Social Security #

___________________________________

_______________________

City/Town

State

Zip

______________________________________________________________________

Address of the dwelling for which credit is claimed:

Street

City/Town

Zip

Licensed hazard reduction contractor (information on reverse)

Name:___________________________________

Lic.# ___________________

CHECK ONE BOX BELOW

Taxpayer is the/an owner of the dwelling listed above.

Taxpayer is a renter/lessee of the dwelling listed above.

CALCULATION:

1.

Amount paid for required lead

removal or lead hazard reduction

for this dwelling unit.

$ ___________

2.

Credit limit per dwelling unit

$

1,000.00

3.

Credit limit (smaller of line 1 or 2)

$ ___________

4.

Credit claimed by this taxpayer.

(Multiple owners must divide. Refer

to instructions and attach details

of division.)

$ ___________

DOCUMENTATION AND CERTIFICATES REQUIRED: Taxpayers MUST ATTACH

copies of certificates from BOTH (1) the certified environmental lead inspector that the

lead removal or lead hazard reduction was required AND (2) the certified environmental

lead inspector that the dwelling unit has been completed in accordance with all

applicable requirements and that the dwelling is acceptable for re-occupancy.

Taxpayers must retain payment documentation to substantiate the amounts paid for

lead removal/reduction.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1