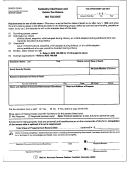

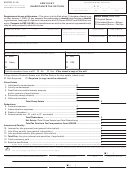

Form 92a201 - Kentucky Inheritance Tax Return Page 2

ADVERTISEMENT

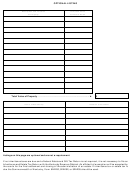

OPTIONAL LISTING

Description and Location

Fair Cash Value

of Property

at Date of Death

$

Total Value of Property ................................................................................

Name of Beneficiary

Relation to Decedent

Listings on this page are optional and are not a requirement.

If no inheritance taxes are due and a Federal Estate and Gift Tax Return is not required, it is not necessary to file an

Inheritance and Estate Tax Return with the Kentucky Revenue Cabinet. An affidavit of exemption will be accepted by

the courts for the final settlement and closing of the administration of an estate. If inheritance tax or estate tax is

due the Commonwealth of Kentucky, Form 92A200, 92A202, or 92A205 should be used.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2