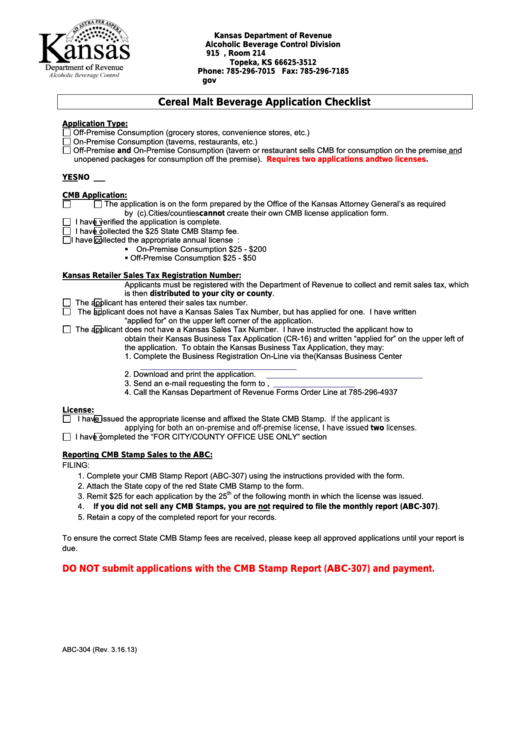

Form Abc-304 - Cereal Malt Beverage Application Checklist

ADVERTISEMENT

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 785-296-7185

ABC.Marketing.Unit@kdor.ks.gov

Cereal Malt Beverage Application Checklist

Application Type:

Off-Premise Consumption (grocery stores, convenience stores, etc.)

On-Premise Consumption (taverns, restaurants, etc.)

Off-Premise and On-Premise Consumption (tavern or restaurant sells CMB for consumption on the premise and

unopened packages for consumption off the premise).

Requires two applications and two

licenses.

YES

NO

CMB Application:

The application is on the form prepared by the Office of the Kansas Attorney General’s as required

by K.S.A. 41-2702(c). Cities/counties cannot create their own CMB license application form.

I have verified the application is complete.

I have collected the $25 State CMB Stamp fee.

I have collected the appropriate annual license fee. The fees are:

On-Premise Consumption $25 - $200

Off-Premise Consumption $25 - $50

Kansas Retailer Sales Tax Registration Number:

Applicants must be registered with the Department of Revenue to collect and remit sales tax, which

is then distributed to your city or county.

The applicant has entered their sales tax number.

The applicant does not have a Kansas Sales Tax Number, but has applied for one. I have written

“applied for” on the upper left corner of the application.

The applicant does not have a Kansas Sales Tax Number. I have instructed the applicant how to

obtain their Kansas Business Tax Application (CR-16) and written “applied for” on the upper left of

the application. To obtain the Kansas Business Tax Application, they may:

1.

Complete the Business Registration On-Line via the(Kansas Business Center

2.

Download and print the application.

3.

Send an e-mail requesting the form to forms@kdor.state.ks.us,

4.

Call the Kansas Department of Revenue Forms Order Line at 785-296-4937

License:

I have issued the appropriate license and affixed the State CMB Stamp. If the applicant is

applying for both an on-premise and off-premise license, I have issued two licenses.

I have completed the “FOR CITY/COUNTY OFFICE USE ONLY” section

Reporting CMB Stamp Sales to the ABC:

FILING:

1.

Complete your CMB Stamp Report (ABC-307) using the instructions provided with the form.

2.

Attach the State copy of the red State CMB Stamp to the form.

th

3.

Remit $25 for each application by the 25

of the following month in which the license was issued.

4.

If you did not sell any CMB Stamps, you are not required to file the monthly report (ABC-307).

5.

Retain a copy of the completed report for your records.

To ensure the correct State CMB Stamp fees are received, please keep all approved applications until your report is

due.

DO NOT submit applications with the CMB Stamp Report (ABC-307) and payment.

ABC-304 (Rev. 3.16.13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1