Form Mb-1 Vermont Malt Beverage Tax Return

ADVERTISEMENT

Vermont Department of Taxes

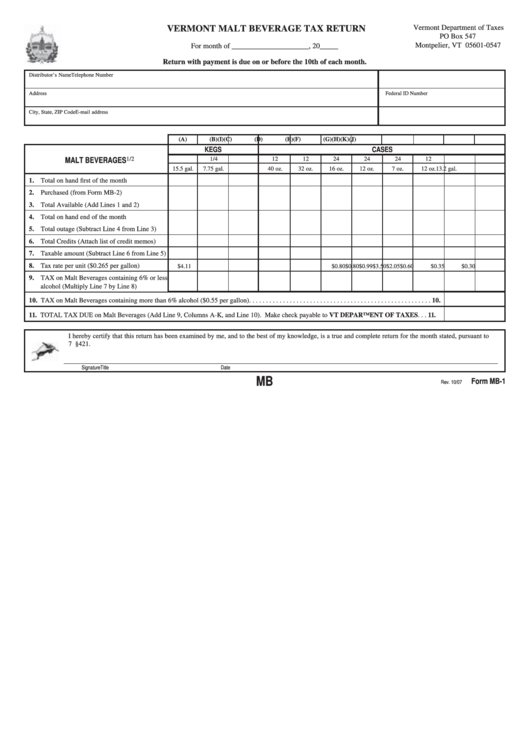

VERMONT MALT BEVERAGE TAX RETURN

PO Box 547

Montpelier, VT 05601-0547

For month of _____________________, 20_____

Return with payment is due on or before the 10th of each month.

Distributor’s Name

Telephone Number

Address

Federal ID Number

City, State, ZIP Code

E-mail address

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

KEGS

CASES

1/2

1/4

12

12

24

24

24

12

MALT BEVERAGES

15.5 gal.

7.75 gal.

13.2 gal.

40 oz.

32 oz.

16 oz.

12 oz.

7 oz.

12 oz.

1. Total on hand first of the month

2. Purchased (from Form MB-2)

3. Total Available (Add Lines 1 and 2)

4. Total on hand end of the month

5. Total outage (Subtract Line 4 from Line 3)

6. Total Credits (Attach list of credit memos)

7. Taxable amount (Subtract Line 6 from Line 5)

8. Tax rate per unit ($0.265 per gallon)

$4.11

$2.05

$3.50

$0.99

$0.80

$0.80

$0.60

$0.35

$0.30

9. TAX on Malt Beverages containing 6% or less

alcohol (Multiply Line 7 by Line 8)

10. TAX on Malt Beverages containing more than 6% alcohol ($0.55 per gallon) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. TOTAL TAX DUE on Malt Beverages (Add Line 9, Columns A-K, and Line 10). Make check payable to VT DEPARTMENT OF TAXES . . . 11.

I hereby certify that this return has been examined by me, and to the best of my knowledge, is a true and complete return for the month stated, pursuant to

7 V.S.A. §421.

Signature

Title

Date

MB

Form MB-1

Rev. 10/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1