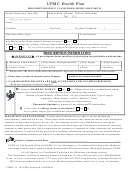

MRA Pay Me Back Claim Form Instructions

Section 1 – One Time Annual Request for Social Security Administration (SSA)

Deducted Premiums (Medicare Part B)

1. Complete this section if your Medicare Part B premium is deducted from your Social

Security check.

2. In the “Service Start Date” boxes, enter the first of the month in which you are eligible for

Medicare Part B for this year. In the “Service End Date” boxes, enter the last day of the

year. (If eligible for Medicare Part B on January 1, this will be January 1 to December 31.)

3. Enter the annual amount of your Medicare Part B payment (the monthly amount

multiplied by the number of months of coverage.)

4. Include a copy of your Social Security Cost of Living Adjustment (COLA) statement as

proof of your expense (typically mailed starting in November the year before it becomes

effective) or any other Medicare statement that clearly indicates your annual Medicare B

premiums. If your premium is not deducted from your Social Security check, please

complete Section 2 (Health Plan Premiums Not Deducted from Your Social Security

Check) on the claim form in order to be reimbursed.

5. We will reimburse you based on your annual premiums. Your monthly reimbursement

will not be more than the current balance in your account or the maximum benefit

available of $600.

Section 2 – Medicare Part B Healthcare Premiums Not Deducted from Your Social

Security Check

1. Complete this section if your Medicare Part B premiums are:

a. not deducted from your Social Security check, and

b. paid by you on an after-tax basis.

2. Make sure to provide documentation, such as the COLA statement, that shows the

premium you pay. After you have paid your Medicare Part B premium, you may use a

front and back copy of the cleared check, a bank statement or credit card statement that

shows the Medicare Part B premium payment.

3. The Service Start and End Dates should represent the period of coverage you paid for

and want reimbursed. These dates should match the COLA statement.

4. Keep your original receipts and make copies to fax or mail to WageWorks.

Note: Pre-tax deductions for premiums from your payroll or your pension plan are not

eligible for reimbursement.

WW-BCBS-FEP-MRA-RT-PMB-INST (Dec 2017)

Page 2

1

1 2

2 3

3