Additional Information

Step 2: Calculate the optional gain on sale

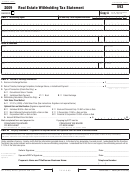

If a failed deferred exchange had boot withheld

withholding amount:

upon in the original relinquished property,

For additional information or to speak to

reduce the withholding amount by the amount

a. Installment payment. . . . . . .$__________

a representative regarding this form, call

previously remitted to the FTB.

the Withholding Services and Compliance

b. Multiply line a by installment

*Tax Rates

telephone service at:

sale withholding percent

calculated in Step 1 . . . . . . .$__________

Individual . . . . . . . . . . . . . . . . . . . . . . . 12.3%

888.792.4900, or

Non-California Partnership . . . . . . . . . . 12.3%

916.845.4900

c. Withholding amount, multiply

Corporation. . . . . . . . . . . . . . . . . . . . . . 8.84%

FAX 916.845.9512

line b by the applicable tax rate*

Bank and Financial Corporation. . . . . . 10.84%

for your filing type . . . . . . . .$__________

Or write to:

S Corporation . . . . . . . . . . . . . . . . . . . . 13.8%

When withholding on the principal portion of

WITHHOLDING SERVICES AND

Financial S Corporation. . . . . . . . . . . . . 15.8%

each installment payment using the Optional

COMPLIANCE

Gain on Sale Election, the seller/transferor

Seller/Transferor Signature

FRANCHISE TAX BOARD

must provide the buyer/transferee with the

PO BOX 942867

A signature is only required by the

Installment Sale Withholding percent to include

SACRAMENTO CA 94267-0651

seller/transferor if the Optional Gain

on Form 593-

.

I

You can download, view, and print California

On Sale Election method is used. If the

Send the original Form 593, the required

tax forms and publications at ftb.ca.gov.

sellers/transferors are married or RDPs and

withholding payment on the principal portion

Or to get forms by mail, write to:

they plan to file a joint return, then your

of the first installment payment, and a copy of

signature and your spouse's/RDP's signature

TAX FORMS REQUEST UNIT

the promissory note to the FTB. Do not attach

are both required.

FRANCHISE TAX BOARD

a copy of the promissory note with subsequent

PO BOX 307

Preparer’s Name and Title/Escrow Business

installment payments.

RANCHO CORDOVA CA 95741-0307

Name

Exchange:

For all other questions unrelated to withholding

Provide the preparer’s name and title/escrow’s

a. Boot Amount. Not to

or to access the TTY/TDD number, see the

business name and phone number.

exceed recognized gain . . . .$__________

information below.

b. Withholding Amount. Multiply

Internet and Telephone Assistance

line a by the applicable tax

Website: ftb.ca.gov

rate* and enter the result

Phone:

800.852.5711 from within the

here and on Form 593,

United States

line 5 . . . . . . . . . . . . . . . . . .$__________

916.845.6500 from outside the

Failed Exchange:

United States

a. Gain on Sale from

TTY/TDD: 800.822.6268 for persons with

Form 593-E, line 16 . . . . . . .$__________

hearing or speech impairments

b. Ownership Percentage. If

Asistencia Por Internet y Teléfono

multiple sellers/transferors

Sitio web: ftb.ca.gov

attempted to exchange this

Teléfono: 800.852.5711 dentro de los

property, enter this

Estados Unidos

seller’s/transferor's

916.845.6500 fuera de los Estados

ownership percentage.

Unidos

Otherwise, enter 100.00% . . . _ _ _ ._ _%

TTY/TDD: 800.822.6268 para personas con

c. Amount Subject to

discapacidades auditivas o del

Withholding. Multiply

habla

line a by line b . . . . . . . . . . .$__________

d. Withholding Amount. Multiply

line c by the applicable tax

rate* and enter the result here

and on Form 593, line 5 . . . .$__________

Page 4 Form 593 Instructions 2015

1

1 2

2 3

3 4

4 5

5