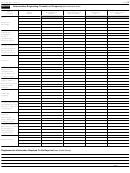

3

Form 926 (Rev. 12-2011)

Page

Additional Information Regarding Transfer of Property (see instructions)

Part IV

9

Enter the transferor’s interest in the foreign transferee corporation before and after the transfer:

(a) Before

% (b) After

%

10

Type of nonrecognition transaction (see instructions)

▶

11

Indicate whether any transfer reported in Part III is subject to any of the following:

a Gain recognition under section 904(f)(3) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b Gain recognition under section 904(f)(5)(F) .

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Recapture under section 1503(d) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

d Exchange gain under section 987 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

12

Yes

No

Did this transfer result from a change in the classification of the transferee to that of a foreign corporation?

13

Indicate whether the transferor was required to recognize income under final and temporary Regulations

sections 1.367(a)-4 through 1.367(a)-6 for any of the following:

a Tainted property

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Depreciation recapture

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

c Branch loss recapture .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

d Any other income recognition provision contained in the above-referenced regulations

Yes

No

.

.

.

.

.

.

.

14

Did the transferor transfer assets which qualify for the trade or business exception under section 367(a)(3)?

Yes

No

15a Did the transferor transfer foreign goodwill or going concern value as defined in Temporary Regulations

section 1.367(a)-1T(d)(5)(iii)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b If the answer to line 15a is “Yes,” enter the amount of foreign goodwill or going concern value

$

transferred

▶

16

Yes

No

Was cash the only property transferred?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17a Was intangible property (within the meaning of section 936(h)(3)(B)) transferred as a result of the

Yes

No

transaction? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b If “Yes,” describe the nature of the rights to the intangible property that was transferred as a result of the

transaction:

926

Form

(Rev. 12-2011)

1

1 2

2 3

3