Colorado Income Tax Filing Guide - 2012 Page 20

ADVERTISEMENT

Page 20

Disclosure of Colorado Expenditures and Revenues

Expenditures by Function

Revenues by Source

Other

Other

Transportation

2.8%

8.0%

4.4%

Justice

Taxes

6.9%

39.2%

Education

42.2%

Federal Grants &

Business, Community

Contracts

& Consumer Affairs

34.2%

10.8%

Interest & Rents

1.7%

Licenses Permits

Social Assistance

Charges for Goods &

& Fines

27.8%

Services

3.4%

18.7%

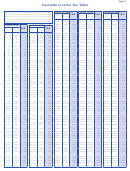

Disclosure of Average Taxes Paid

Fiscal Year 2010

Adjusted Family Money Income

Less

$10,000

$15,000

$20,000

$30,000

$40,000

$50,000

$70,000

$80,000

$100,000

than

to

to

to

to

to

to

to

to

and

$10,000

$15,000

$20,000

$30,000

$40,000

$50,000

$70,000

$80,000

$100,000

over

Average

State Taxes:

________________________________________________________________________________________________________________

Individual Income

$40

$89

$182

$369

$671

$971

$1,412

$1,917

$2,469

$6,418

$1,830

Sales

155

191

194

251

324

343

444

536

608

1120

471

Gasoline and Special Fuels

53

69

86

110

128

148

171

186

201

302

159

Licenses and Registrations

53

58

80

87

114

140

153

173

198

255

141

Alcoholic Beverages

3

3

2

4

6

6

9

13

12

31

10

Cigarettes and Tobacco

46

60

69

85

79

74

86

90

76

91

78

Total State Taxes

$350

$470

$613

$906

$1,322

$1,681

$2,275

$2,915

$3,563

$8,216

$2,691

Local Taxes:

Residential Property

$341

$391

$694

$856

$937

$1,027

$1,609

$1,687

$1,824

$3,161

$1,418

Sales and Use

244

301

304

394

509

538

697

841

955

1,758

740

Specific Ownership

42

71

86

100

118

134

158

170

192

287

149

Occupation

2

5

7

10

15

20

27

34

42

66

26

Total Local Taxes

$630

$767

$1,092

$1,361

$1,580

$1,719

$2,491

$2,732

$3,014

$5,272

$2,334

Federal Taxes:

Individual Income

$392

$508

$708

$1,169

$2,022

$2,959

$4,574

$6,313

$8,184

$32,228

$7,932

Medicare **

137

276

388

589

876

1,153

1,536

1,966

2,419

4,396

1,603

Social Security **

481

969

1,365

2,072

3,081

4,053

5,402

6,912

8,506

13,274

5,258

Total Federal Taxes

$1,010

$1,752

$2,461

$3,831

$5,980

$8,165

$11,512

$15,191

$19,109

$49,898

$14,793

Total Taxes Paid

Households & Employers **

$1,990

$2,989

$4,166

$6,097

$8,882

$11,565

$16,277

$20,838

$25,686

$63,386

$19,817

Less Taxes Paid by Employer

309

622

877

1,331

1,979

2,603

3,469

4,439

5,463

8,835

3,430

Households Only

$1,681

$2,367

$3,289

$4,766

$6,903

$8,962

$12,808

$16,399

$20,224

$54,551

$16,387

** Employers and households both pay taxes to Medicare and Social Security on employees’ behalf.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24