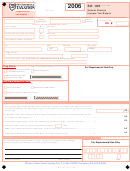

Do not use staples.

Taxable year beginning in

Rev. 11/13

SD 100

2013

School District

13020106

Use only black ink.

Income Tax Return

File a separate Ohio form SD 100 for each taxing school district in which you lived during the taxable year.

Enter school district # for this

return (see pages SD 7-8).

If deceased

If deceased

Taxpayer Social Security no. (required)

Spouse’s Social Security no.

(only if joint return)

SD#

check box

check box

Use UPPERCASE letters.

Your fi rst name

M.I.

Last name

Spouse’s fi rst name (only if married fi ling jointly)

M.I.

Last name

Mailing address (for faster processing, use a street address)

Ohio county (fi rst four letters)

City

State

ZIP code

Home address (if different from mailing address) – do NOT show city or state

ZIP code

County (fi rst four letters)

Foreign country (provide this information if the mailing address is outside the U.S.)

Foreign postal code

School District Residency –

File a separate Ohio form SD 100 for each taxing school district in which you lived during the taxable year.

Check applicable box

Check applicable box for spouse (only if married fi ling jointly)

Full-year

Full-year nonresident

Part-year resident

Full-year

Part-year resident

Full-year nonresident

resident

of SD# above

of SD# above

resident

of SD# above

of SD# above

Enter date of nonresidency

to

Enter date of nonresidency

to

Filing Status –

Check one (must match Ohio income tax return):

Do not use staples, tape or glue. Place your W-2(s), check

Single, head of household or qualifying widow(er)

(payable to School District Income Tax) and Ohio form

SD 40P after the last page of your return. Include forms W-2G

Married fi ling jointly

and 1099-R if tax was withheld. Place any other supporting

Married fi ling separately

documents or statements after the last page of your return.

(enter spouse’s SS#)

Go paperless. It’s FREE!

Tax Type –

Check one (for an explanation, see page SD 1 of the instructions)

Visit tax.ohio.gov to try Ohio I-File.

I am fi ling this return because during the taxable year I lived in a(n):

Most electronic fi lers receive their refunds

Traditional tax base school district. You must start with Schedule A,

line 17 on page 2 of this return.

in 5-7 business days by direct deposit!

Earned income only tax base school district. You must start with

Schedule B, line 22 on page 2 of this return.

INCOME INFORMATION

1. School district taxable income: Traditional tax base: Enter on this line the amount you show on

0 0

.

line 21. Earned income tax base: Enter on this line the amount you show on line 25 ...................... 1.

2. School district tax rate (to fi nd the applicable decimal rate, see pages SD 7-8 of the

0 0

.

.

instructions)

times line 1 .................................................................................... 2.

0 0

.

3. Senior citizen credit (you must be 65 or older to claim this credit; limit $50 per return) .............. 3.

0 0

.

4. Total due (line 2 minus line 3; enter -0- if less than zero) .............................................................. 4.

5. Interest penalty on underpayment of estimated tax. Enclose Ohio form IT/SD 2210 and the

0 0

.

appropriate worksheet if you annualize ......................................................................................... 5.

0 0

.

6. Total due plus IT/SD 2210 interest penalty (add lines 4 and 5) ........................... TOTAL TAX

6.

NO Payment Enclosed –

Mail to: School District Income Tax, P.O. Box 182197, Columbus, OH 43218-2197

MAILING INFORMATION:

Payment Enclosed –

Mail to: School District Income Tax, P.O. Box 182389, Columbus, OH 43218-2389

2013 SD 100

2013 SD 100

pg. 1 of 2

1

1 2

2 3

3 4

4