Form M500X instructions

Line 2

Signature

Important news

Enter your purchases of taxable goods and

An authorized representative of the quali-

If you are a qualified business, failure to

services that were primarily used or con-

fied business must sign and date the form.

submit Form M500 will result in removal

sumed in the zone during the year you are

from the JOBZ program. You will also be

amending.

Where to file

subject to repayment of prior JOBZ tax

Do not include:

benefits received.

Mail Form M500X to:

•

purchases of capital equipment where

Minnesota Revenue

you have received, or expect to receive,

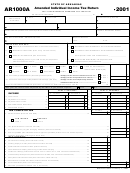

This form is used to amend Form M500, re-

Mail Station 9901

a refund of sales or use tax,

porting sales and use tax benefits you received

St. Paul, MN 55146-9901

for participating in a Job Opportunity Build-

•

purchases of motor vehicles or con-

or fax to: 651-556-3102

ing Zone (JOBZ).

struction materials and supplies, or

Use of information

•

product production purchases such as

Qualified business

raw materials and utilities. Materials

All information provided on Form M500 is

You are a qualified business if your place of

and utilities used or consumed in pro-

nonpublic and cannot be disclosed to others

business is located within a JOBZ zone and

ducing products for resale are already

without your consent.

you have signed a Business Subsidy Agree-

exempt.

ment with the zone administrator.

The information will be used to administer

Line 3

the JOBZ program, however, and may be

County and parcel ID number

Enter the purchases made by you, or a con-

shared with other state agencies, to the ex-

tent necessary to administer the JOBZ laws.

tractor or subcontractor, of construction

Enter the county in which the qualified

materials and supplies used to construct

business is located.

Questions or need forms?

improvements to real property used by the

Enter the property’s primary parcel ID or

qualified business in the zone during the

You can find forms and the most cur-

property ID number assigned to it by the

year you are amending.

rent information on our website at

county. You can find the parcel or property

Ask your contractor for his or her purchas-

ID number on the property tax statement.

ing information.

If you have questions, call 651-556-6836

Attach a sheet with additional parcel num-

during business hours. TTY users, call Min-

Line 4

bers if more than one number is located

nesota Relay at 711.

within the zone.

A motor vehicle purchased by a qualified

business is exempt if the motor vehicle is

We’ll provide information in other formats

Email address

principally garaged in the zone and is pri-

upon request.

marily used as part of, or in direct support

If the department has questions regarding

of, the business’s operations carried on in

your Form M500 and you want to receive

the zone.

correspondence electronically, be sure to

provide your email address.

Enter the Vehicle Identification Number

(VIN) and purchase price under line 4. If

Line instructions

more than four vehicles are used, complete

Form M500A, JOBZ Motor Vehicle Purchase

Line 1

Report. Enter additional VINs/amounts of

Check the appropriate box to indicate if you

purchase on the form and send with Form

received any tax benefits for participating in

M500.

a zone during the year you are amending.

Line 5

If you did not receive any tax benefits, ex-

If the qualified business is located in an area

plain your situation, sign and file the form.

with a local sales and use tax, be sure to

Lines 2–5

enter the area on the line provided.

Complete lines 2 through 5 if you (or, in

Visit our website for a listing of local tax

some cases, your contractor) made pur-

areas for the year you are amending.

chases in the year you are amending that

were exempt from state and local sales taxes

for participating in a zone.

1

1 2

2