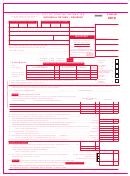

Form ICCR Instructions

Note: Law Change for Individual

form by Feb. 28 of each calendar year you

The Law

work for the construction contractor and

Construction Contractors

Construction contractors are required to

qualify for this reciprocity exemption. If you

After June 30, 2012, businesses are no

deduct and withhold 2 percent Min-

do not complete this form and give it to the

longer required to withhold 2 percent from

nesota income tax from payments made

construction contractor, they are required to

payments made to individual construction

to individual construction contractors

withhold 2 percent of Minnesota income tax

contractors. For details, see “Law Change

for work performed in Minnesota. Pay-

from payments made to you.

for Individual Construction Contractors”

ments are subject to 2 percent withhold-

under the What’s New tab in Withholding

Fill Out the Form Completely

ing if the work was performed in Min-

Tax on our website at

nesota and the total payments during

If you do not complete every item on this

mn.us.

the year exceed $600. [M.S. 290.92, subd.

form, the construction contractor (payer) is

4a(3) and 31]

required to withhold 2 percent Minnesota

Individual Construction

income tax from your pay.

Definitions

Contractors (Payees)

A construction contractor (payer) is

Penalties

any individual or business entity car-

If you knowingly make any statements on

Qualifying Information Regarding

rying on a trade or business described

this form you know are incorrect, you may be

Residency

in industry code numbers 23 through

assessed a $500 penalty.

Minnesota has income tax reciprocity

238990 of the North American Industry

agreements with Michigan and North

Classification System (NAICS). For a

Use of Information

Dakota. If you are a resident of one of these

description of the industry codes, go to

All information on Form ICCR is private by

states and you return to your state of resi-

state law. It may only be given to your state

dence at least once a month:

of residence, the Internal Revenue Service

Examples of construction trades covered

• income from personal services is exempt

and to other state tax agencies as provided

by this law include, but are not limited

from Minnesota income tax; and

by law. The information may be compared

to, residential and commercial building

with other information you furnished to the

• payments for personal services you

construction, residential remodeling,

Department of Revenue. Your name, address

receive as an individual construction

framing and finish carpentry, masonry,

and Social Security number are required for

contractor are not subject to the 2 percent

roofing and siding, electrical contract-

identification. Your address is also required

Minnesota withholding.

ing, plumbing and HVAC, drywall,

to verify your state of residence. The con-

painting and flooring.

Note: The income tax reciprocity agreement

struction contractor’s name, Minnesota tax

between Minnesota and Wisconsin ended

An individual construction contractor

ID number, address and phone number are

Dec. 31, 2009.

(payee) is any individual carrying on a

required in case we have to contact them re-

trade or business as a sole proprietorship

garding the tax withheld from your pay. The

Qualifying Information Regarding

described in industry code numbers 23

only information not required is your phone

Personal Service Income and

through 238990 of the NAICS. A single

number. However, we ask that you provide

Business Income

member Limited Liability Company

it so we can contact you quickly if we have

Personal service income (payments for

(LLC) is not a sole proprietorship for

questions.

professional services personally provided by

purposes of this law.

you) qualifies for the reciprocity exemption.

Construction Contractors

The term “carrying on a trade or busi-

Business income generated by your

ness” generally includes any activity

(Payers)

employees or resulting from the sale of

conducted for the production of income

goods does not qualify for reciprocity if

from selling goods or performing ser-

If you are making payment to an individual

that income is more than incidental. The

vices. Carrying on a trade or business

construction contractor (payee) who is a

services performed by employees or sales

includes all business activities (primary,

resident of a reciprocity state and they have

of goods are incidental if they are a minor

secondary, etc.).

not given you a properly completed Form

contribution to the income of the business.

ICCR, you must withhold 2 percent income

The salary you pay all employees, together

tax from their pay for work performed in

Information and Assistance

with the gross profit from the sales of goods,

Minnesota.

is presumed incidental if it is less than the

Additional forms and information, includ-

In addition, individual construction contrac-

greater of either $20,000 or 10 percent of the

ing fact sheets and frequently asked ques-

tors (payees) are required to give you a new

gross profit of the business.

tions, are available on our website.

Form ICCR each calendar year by Feb. 28.

If You Qualify for the Reciprocity

Website: mn.us

Send the completed form within 30 days of

Exemption and Do Not Want

receipt to Minnesota Revenue, Mail Station

Email:

withholding.tax@state.mn.us

Minnesota Income Tax Withheld

6501, St. Paul, MN 55146-6501. You must

Phone: 651-282 9999 or 1-800-657-3594.

From Your Pay

keep a copy of all Forms ICCR for five years

(

Call 711 for Minnesota Relay)

TTY:

from the date received. You may be assessed a

To avoid having Minnesota income tax

We’ll provide information in other formats

$50 penalty for each form you are required to

withheld from your pay, you must complete

upon request to persons with disabilities.

send us but do not.

Form ICCR and give it to the construc-

tion contractor (payer) before they make

payment to you. You must provide a new

1

1 2

2